Learning Center

Master your finances with 38 expert guides across 6 categories

Budgeting Basics

Master the fundamentals of budgeting and expense tracking

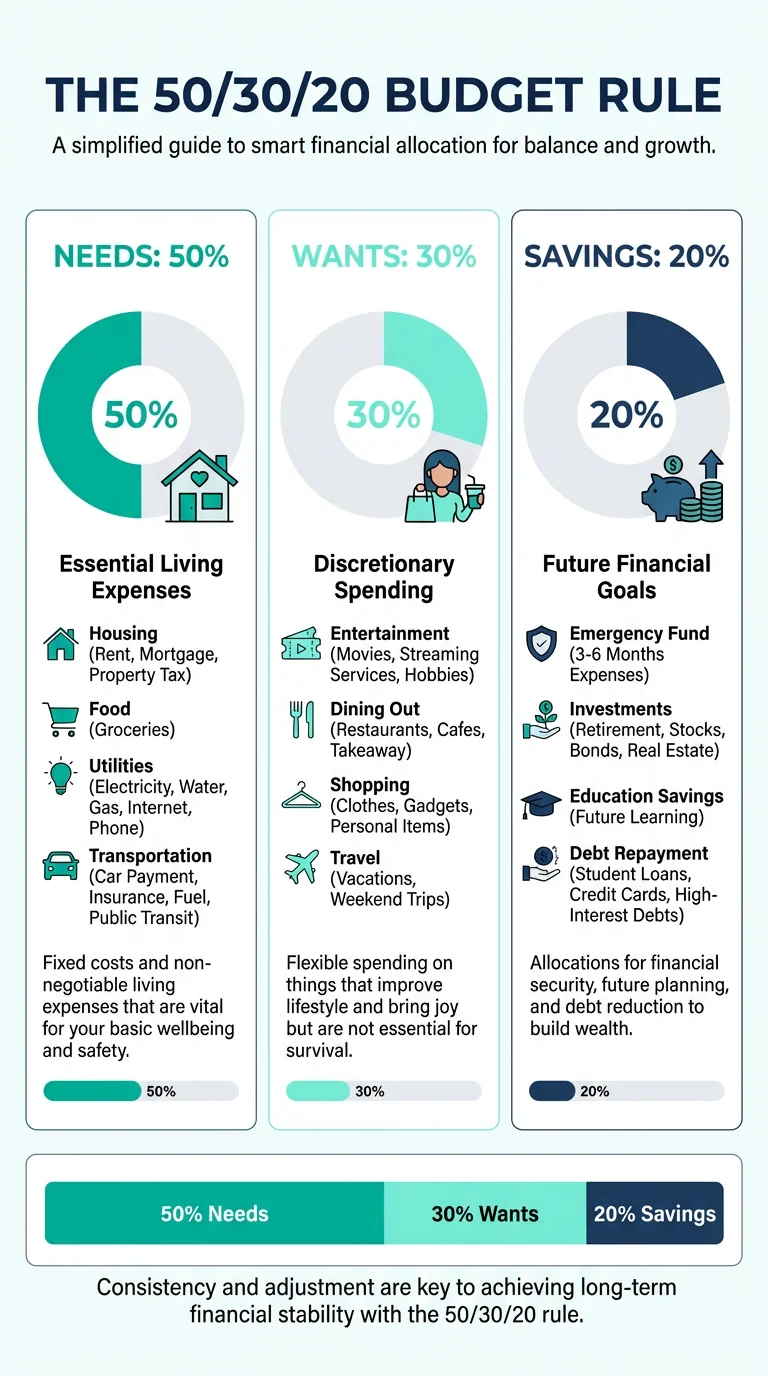

The 50/30/20 Budget Rule

Learn how to allocate 50% needs, 30% wants, 20% savings

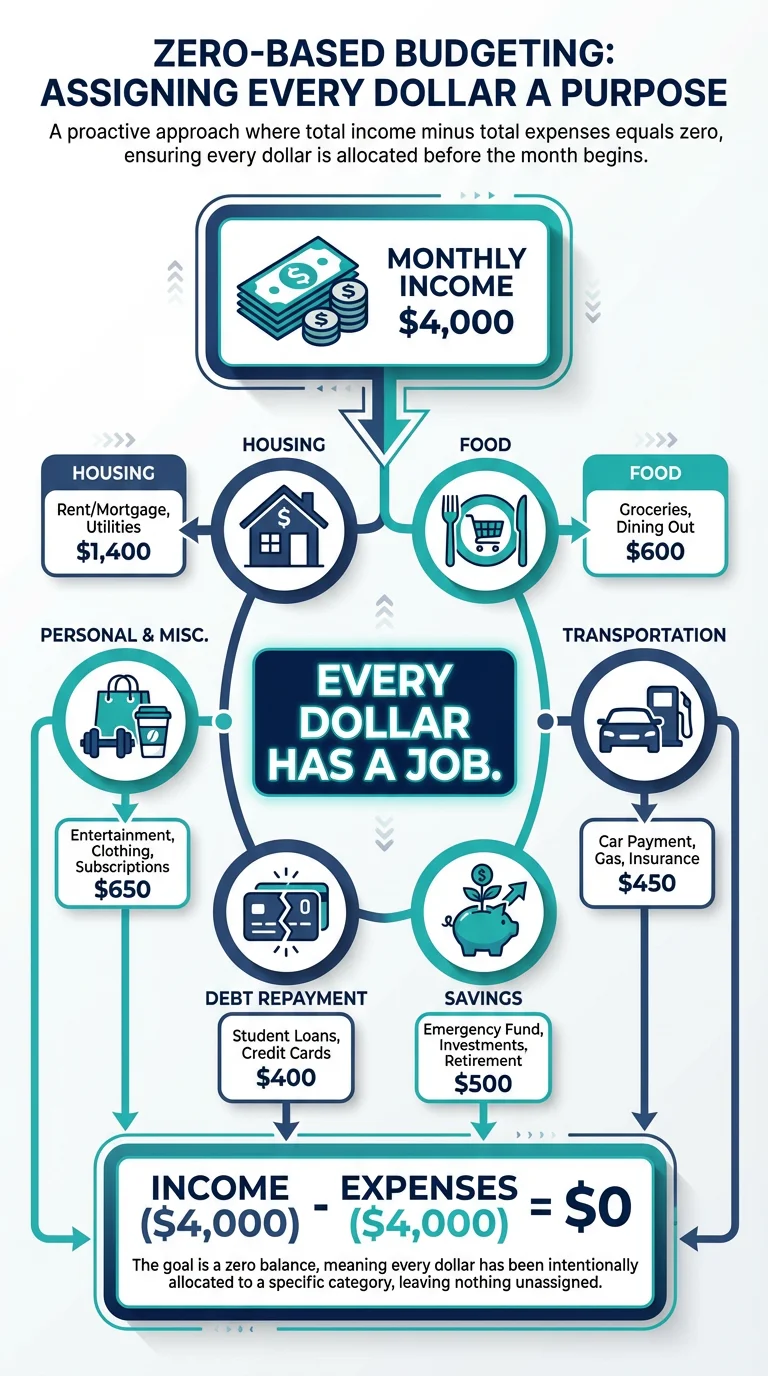

Zero-Based Budgeting

Give every dollar a job with this powerful budgeting method

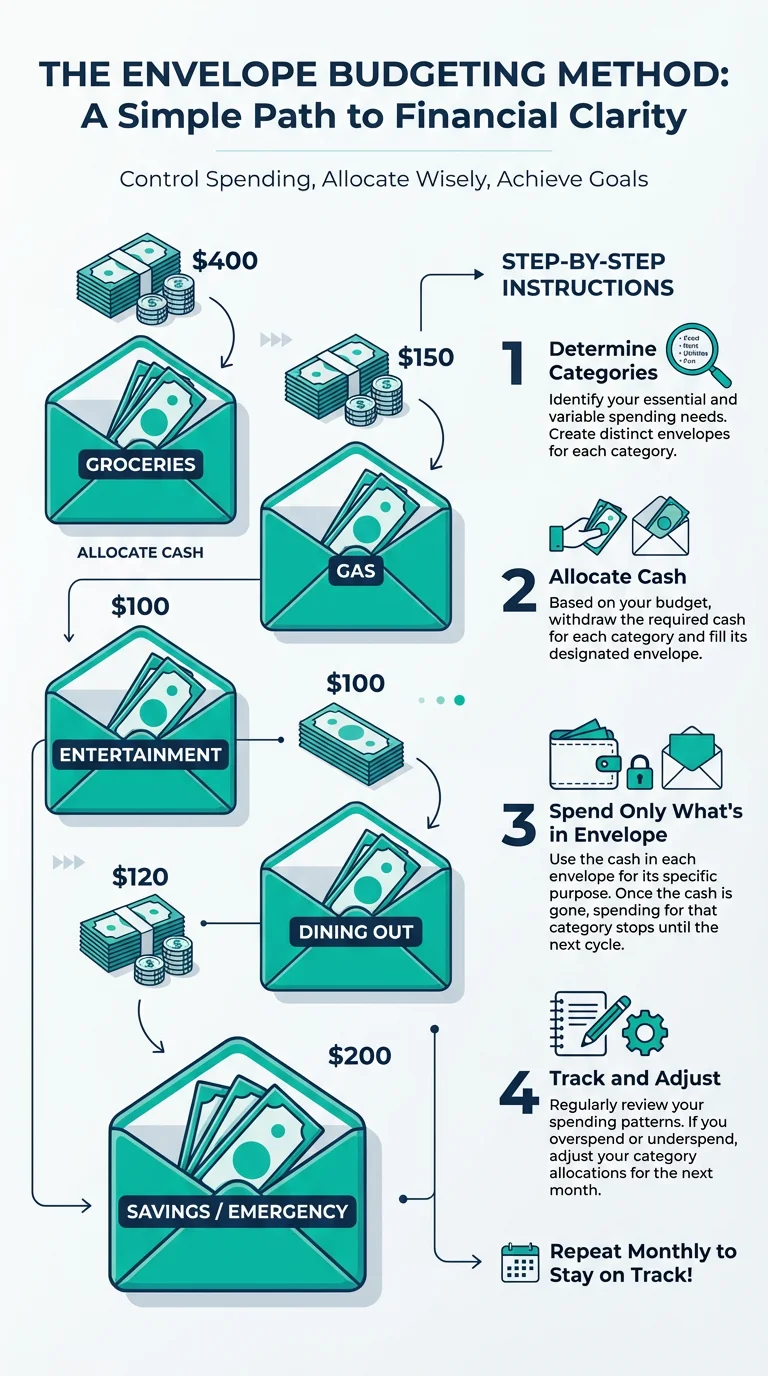

The Envelope Method

Traditional cash-based budgeting for modern times

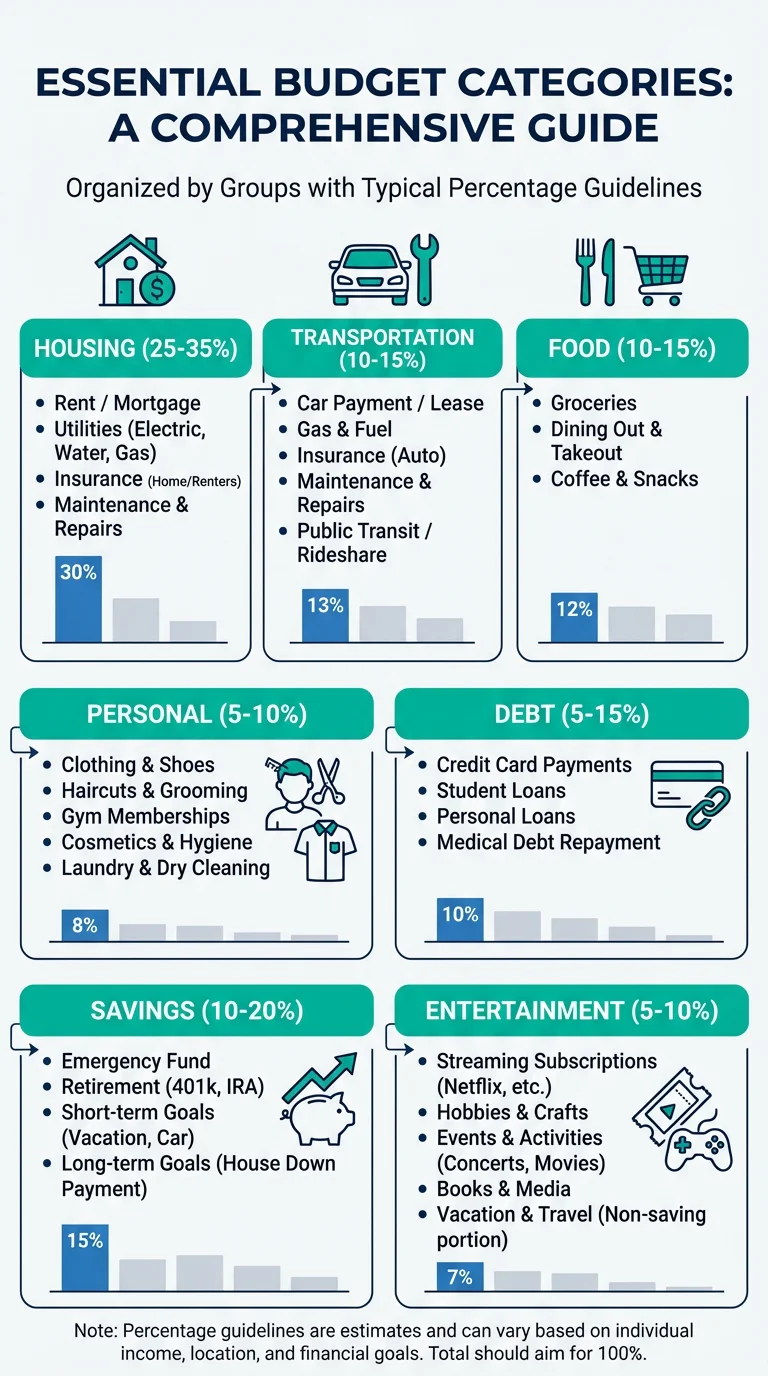

Essential Budget Categories

Complete list of categories to track your spending

How to Track Expenses Effectively

Tools and techniques for accurate expense tracking

Common Budgeting Mistakes to Avoid

Learn from others' mistakes and budget smarter

Saving Strategies

Build wealth through smart saving habits

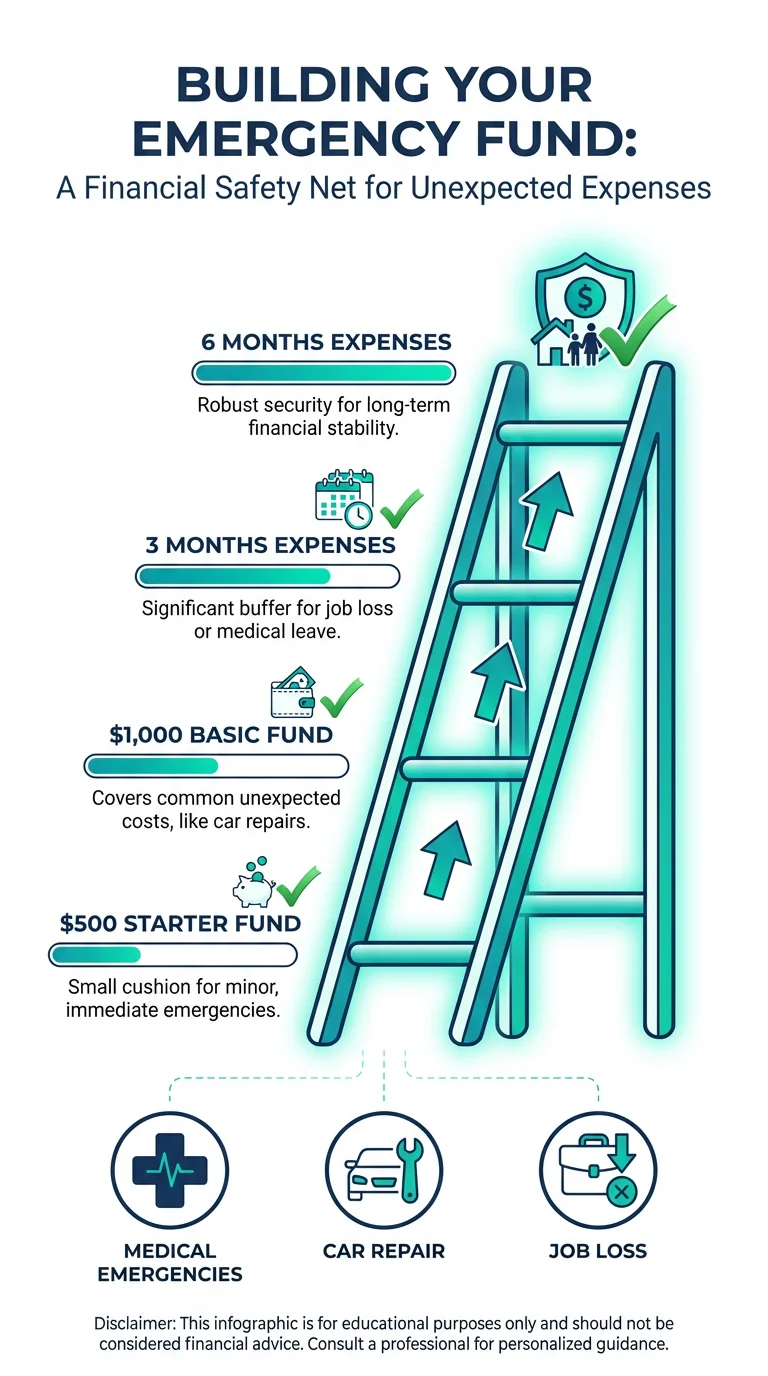

Building Your Emergency Fund

Why you need 3-6 months of expenses saved

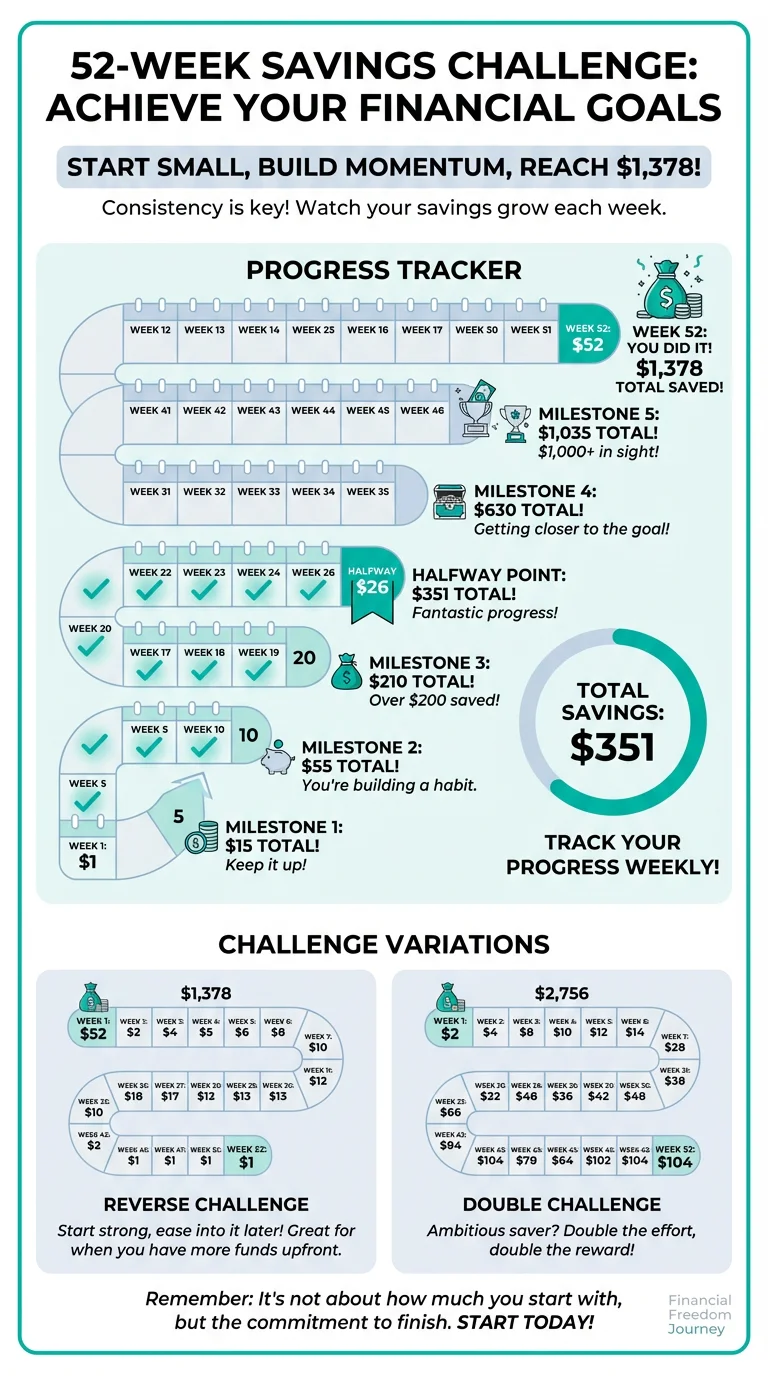

52-Week Savings Challenge

Save over $1,300 in one year with this simple plan

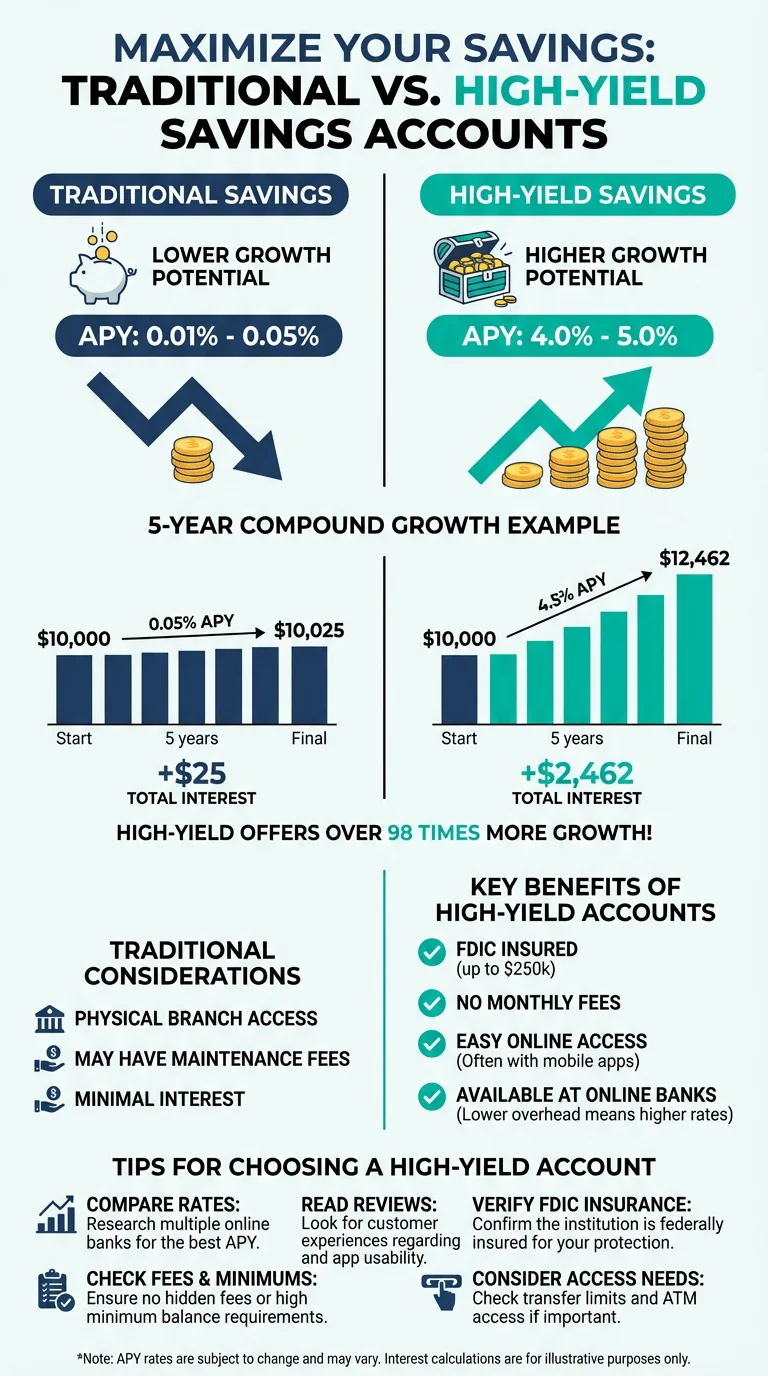

High-Yield Savings Accounts Explained

Maximize your savings with better interest rates

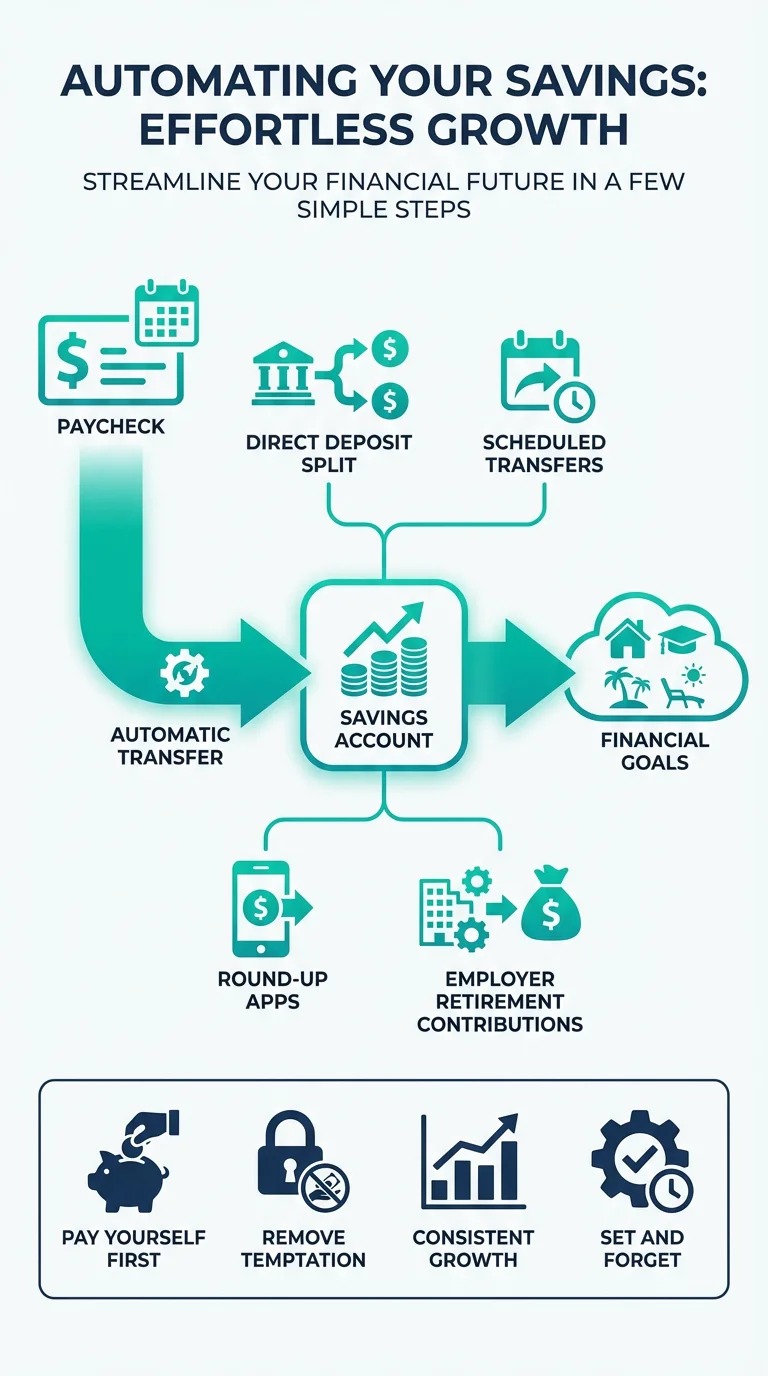

Automating Your Savings

Set it and forget it: automatic wealth building

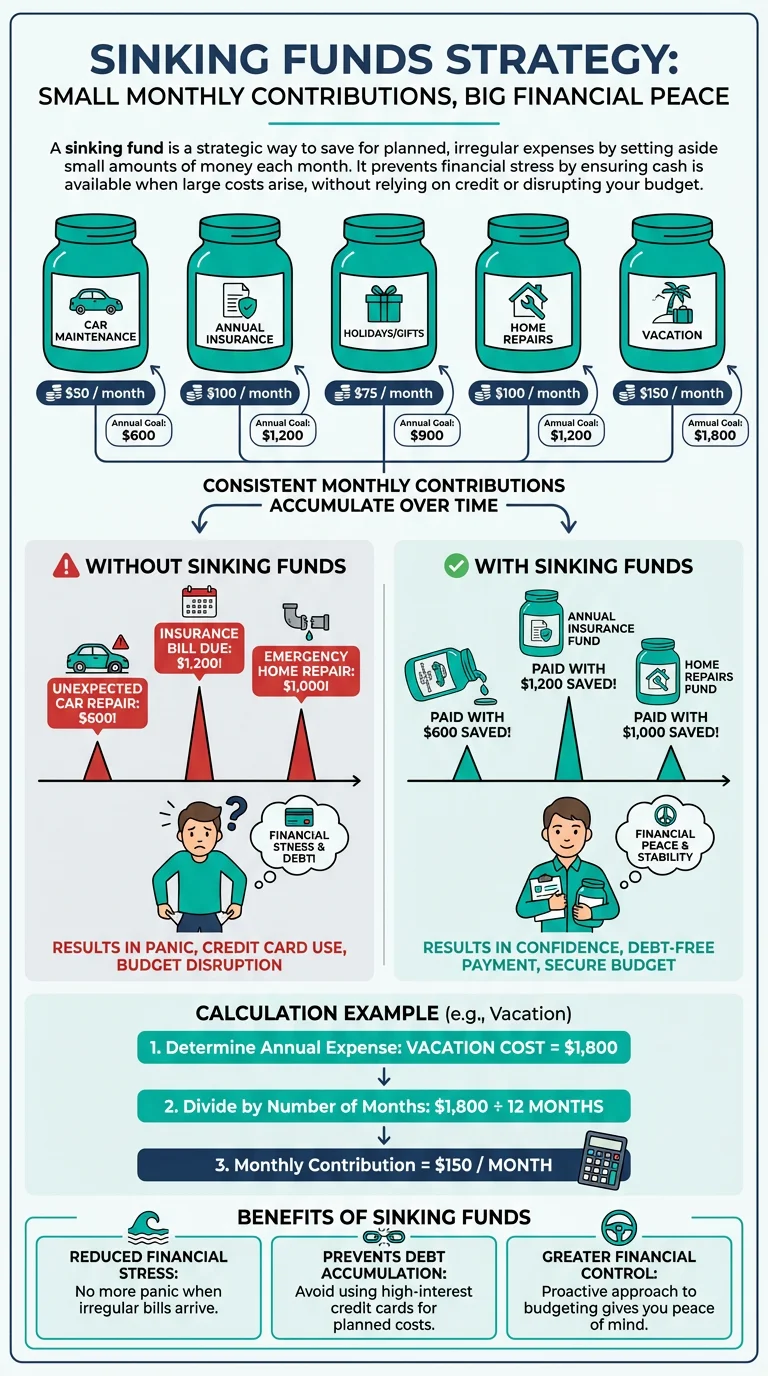

Sinking Funds Strategy

Save for irregular expenses without stress

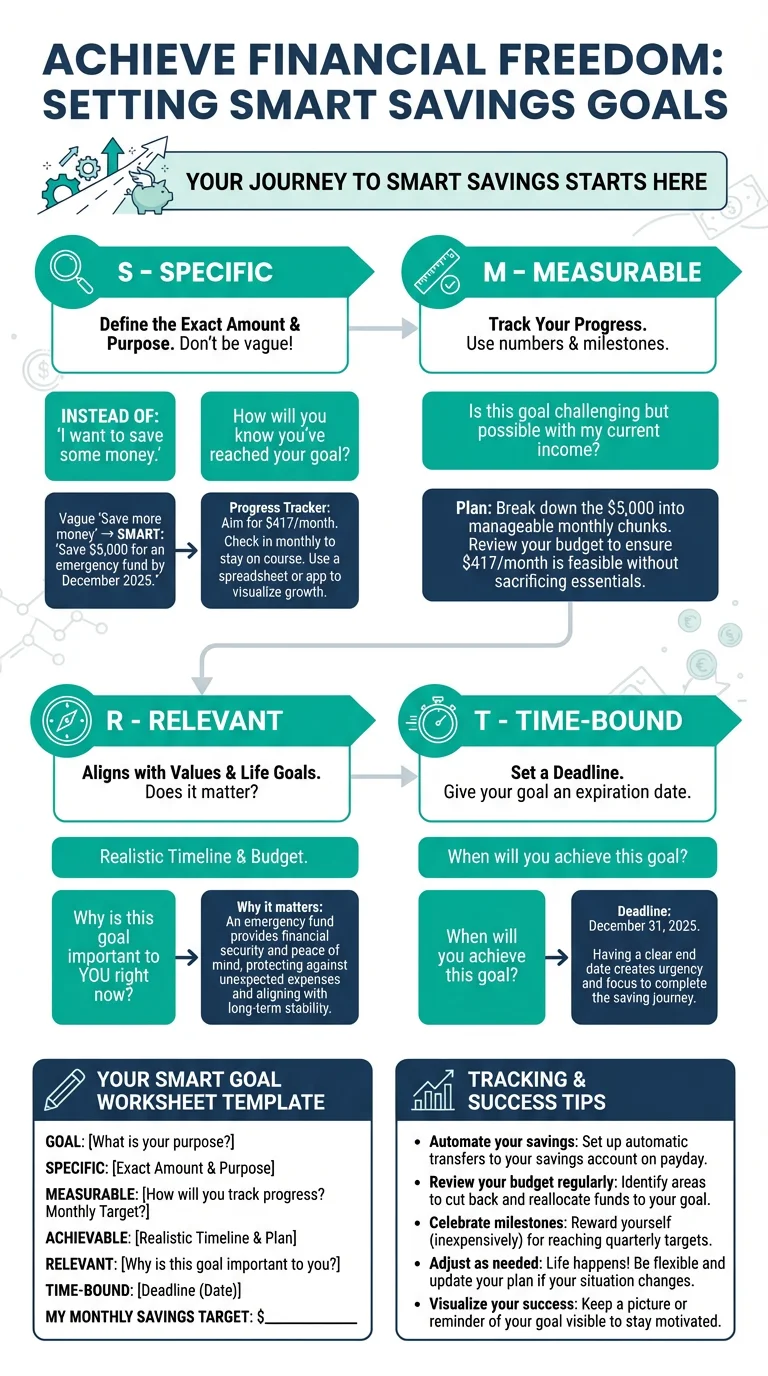

Setting SMART Savings Goals

Specific, Measurable, Achievable, Relevant, Time-bound

Debt Management

Strategies to eliminate debt and achieve financial freedom

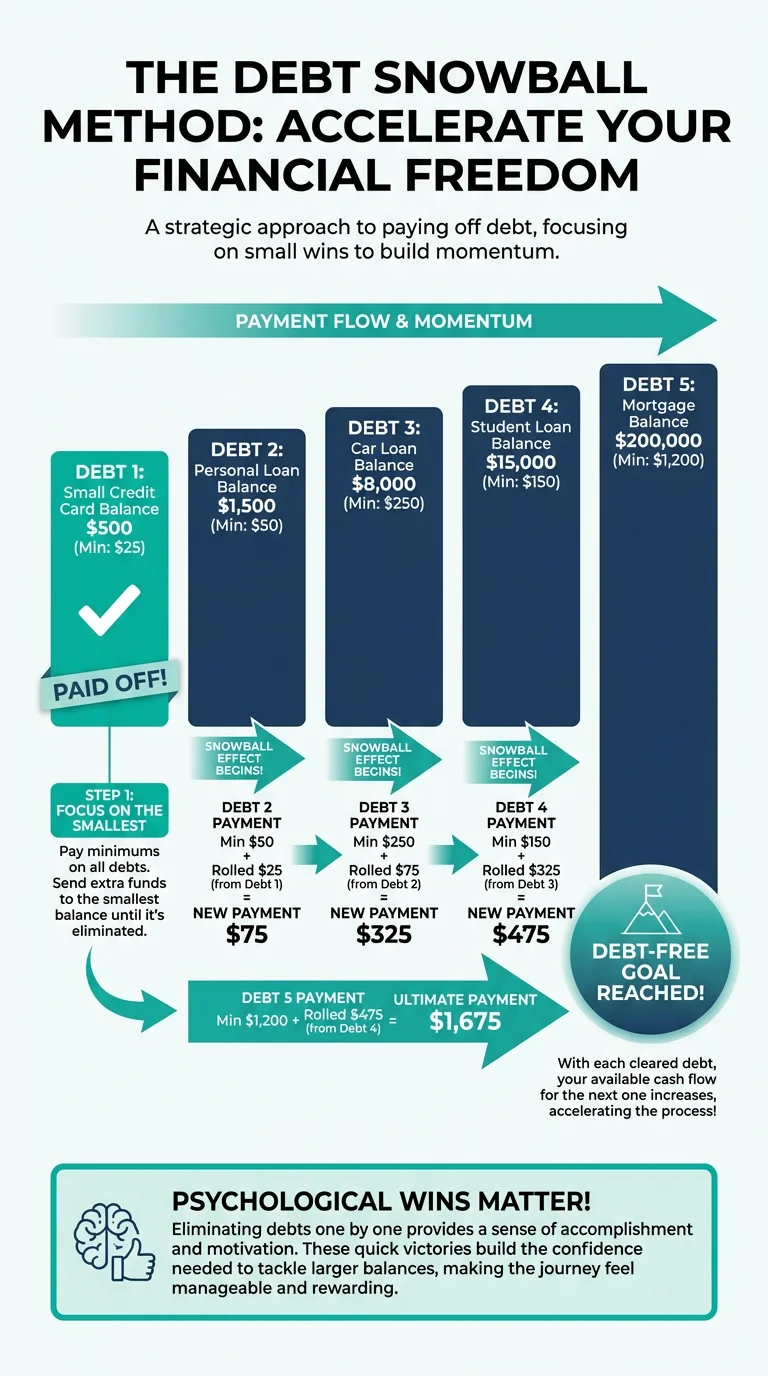

Debt Snowball Method

Pay off smallest debts first for psychological wins

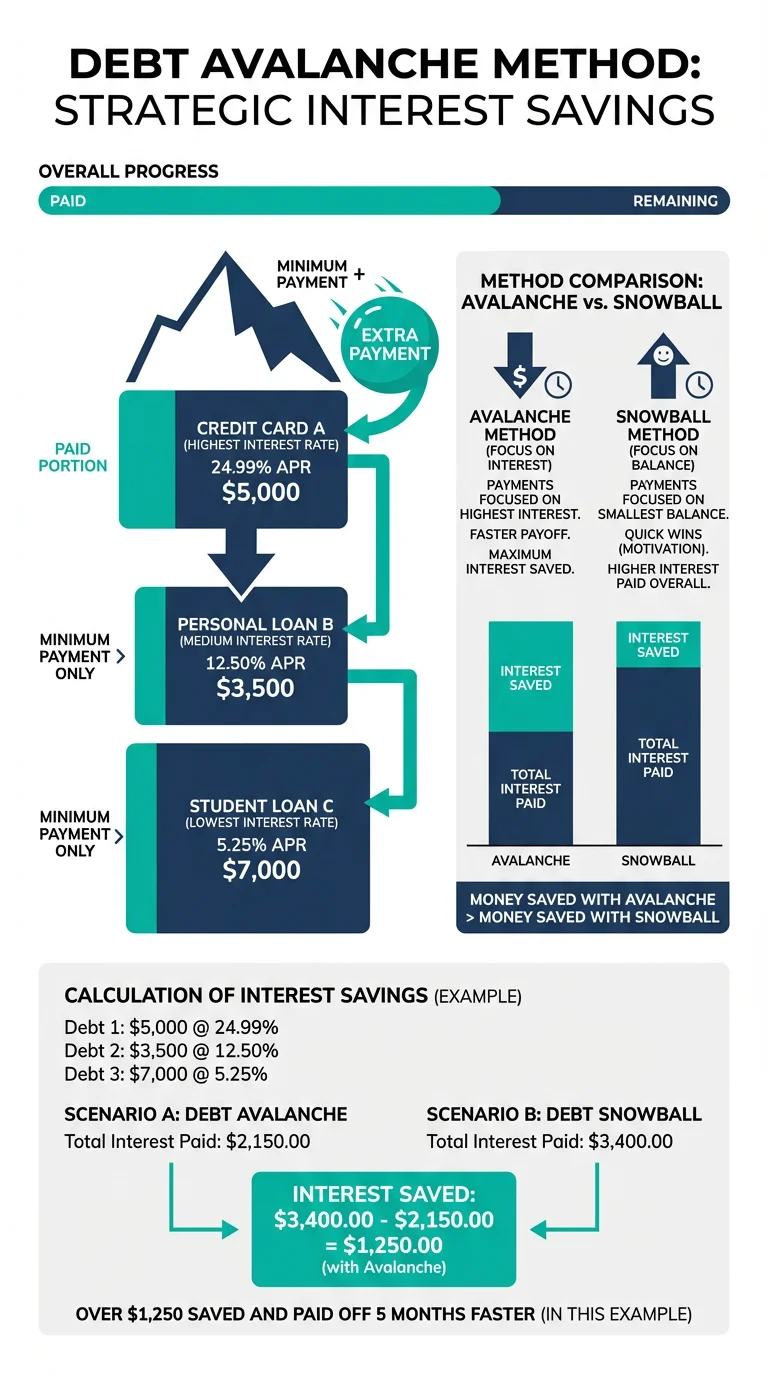

Debt Avalanche Method

Pay off highest interest debts first to save money

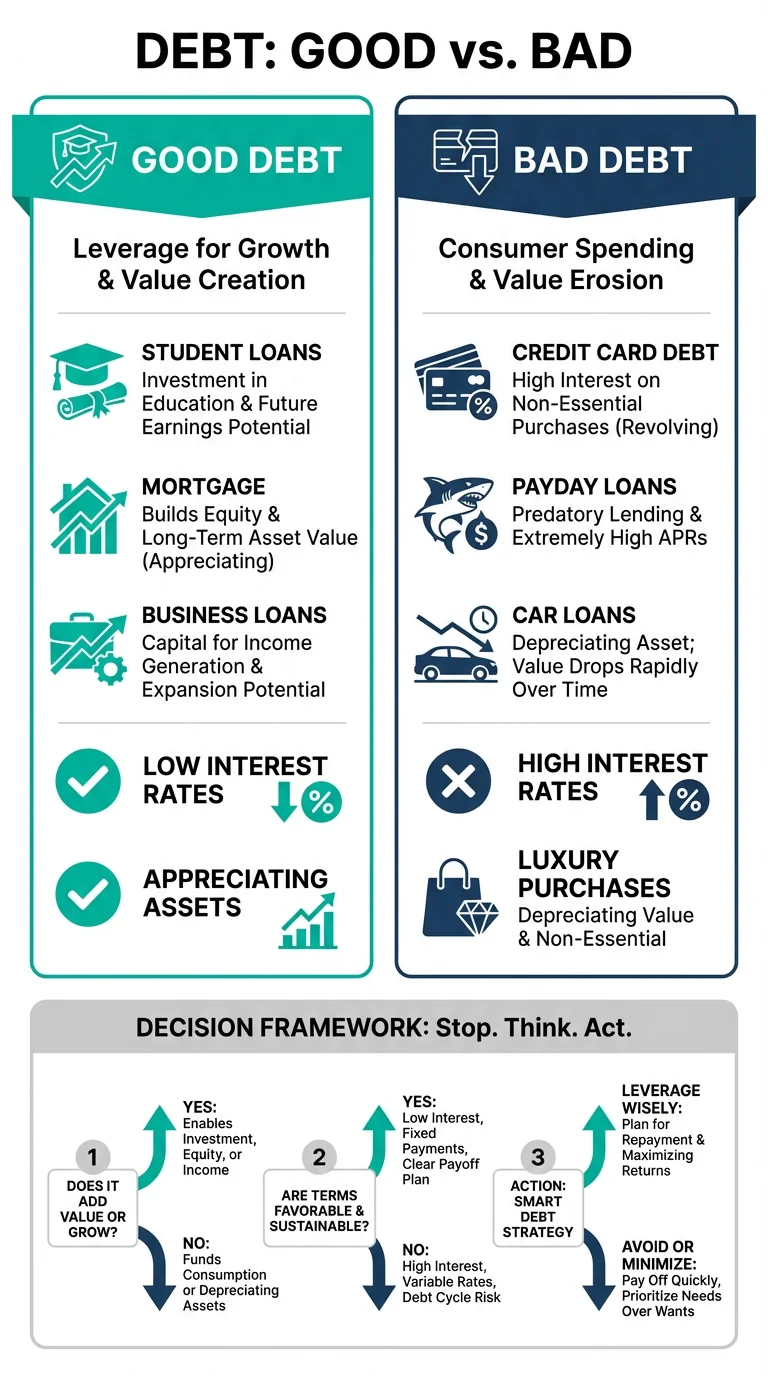

Good Debt vs Bad Debt

Understanding which debts help vs hurt your finances

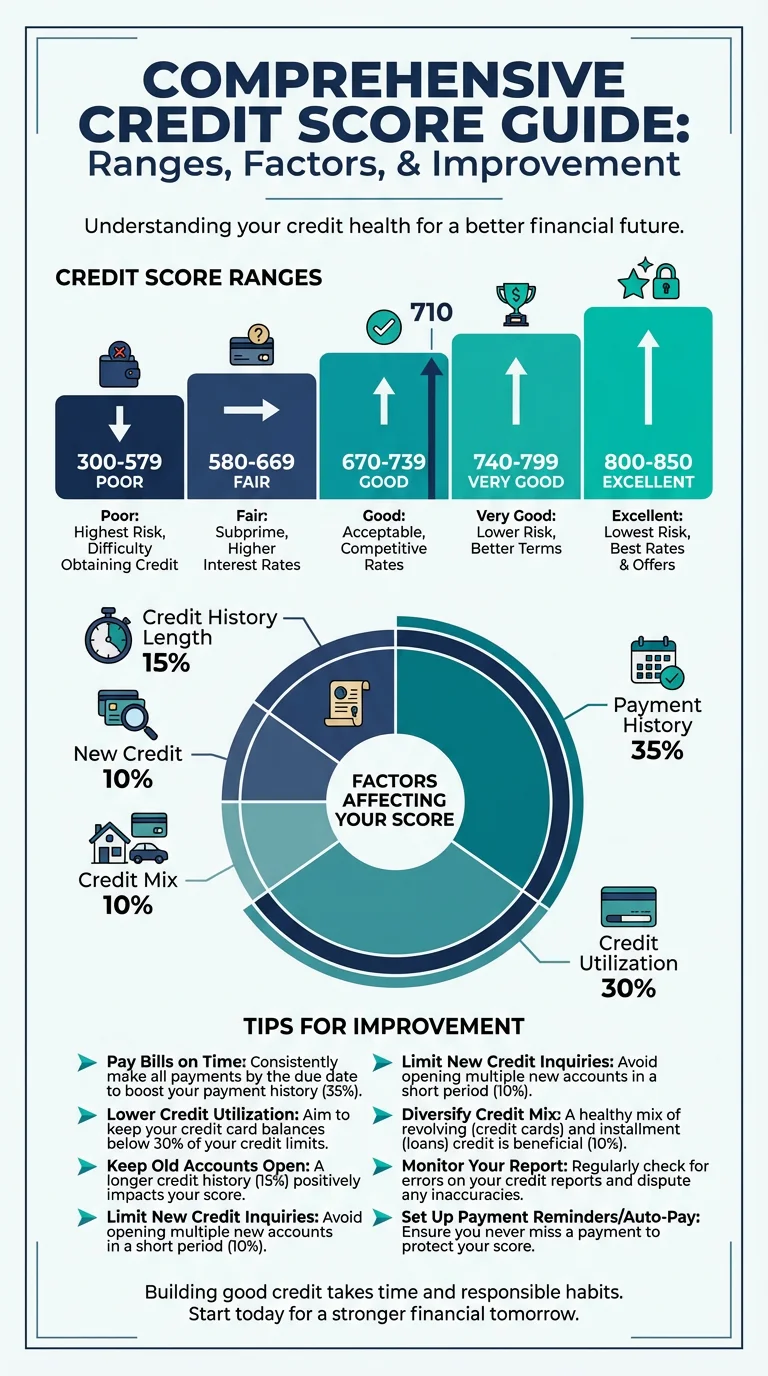

Understanding Your Credit Score

What affects your score and how to improve it

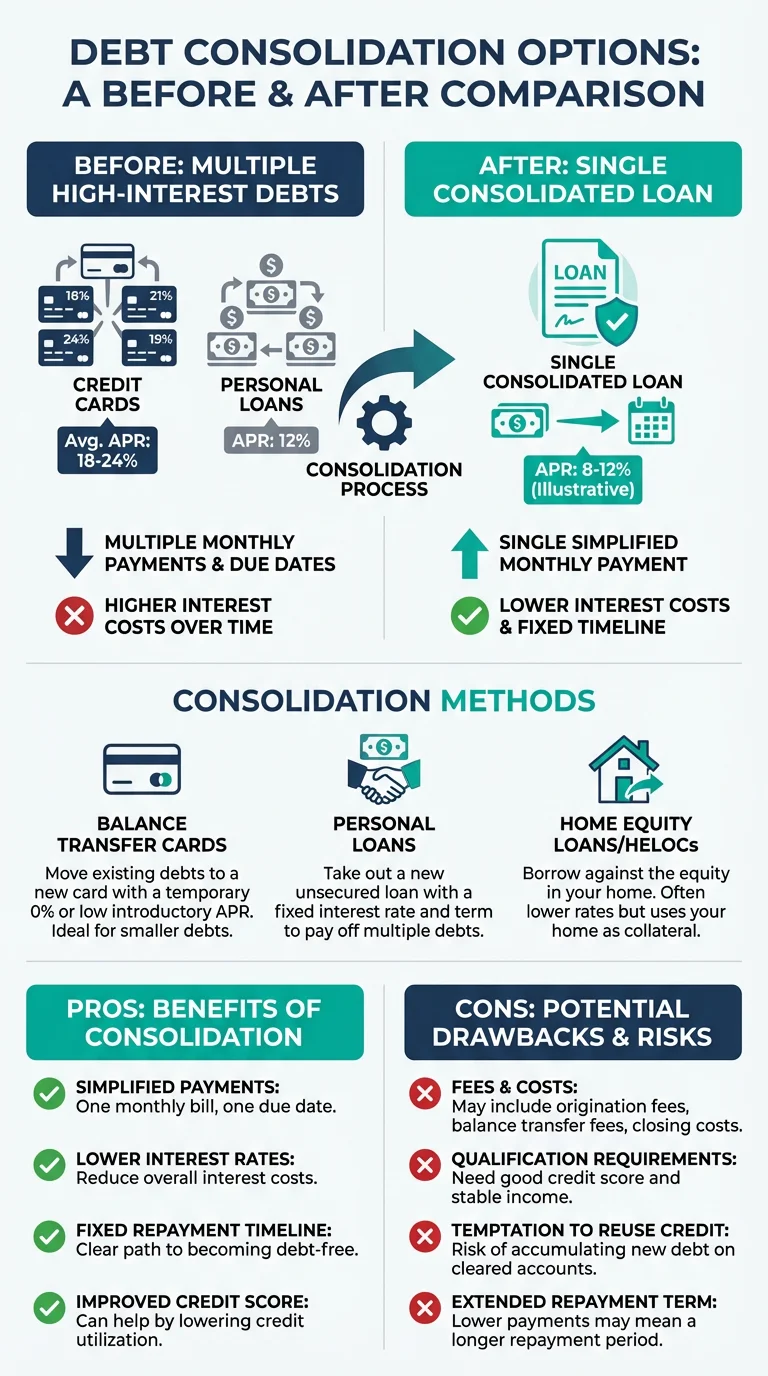

Debt Consolidation Options

When and how to consolidate multiple debts

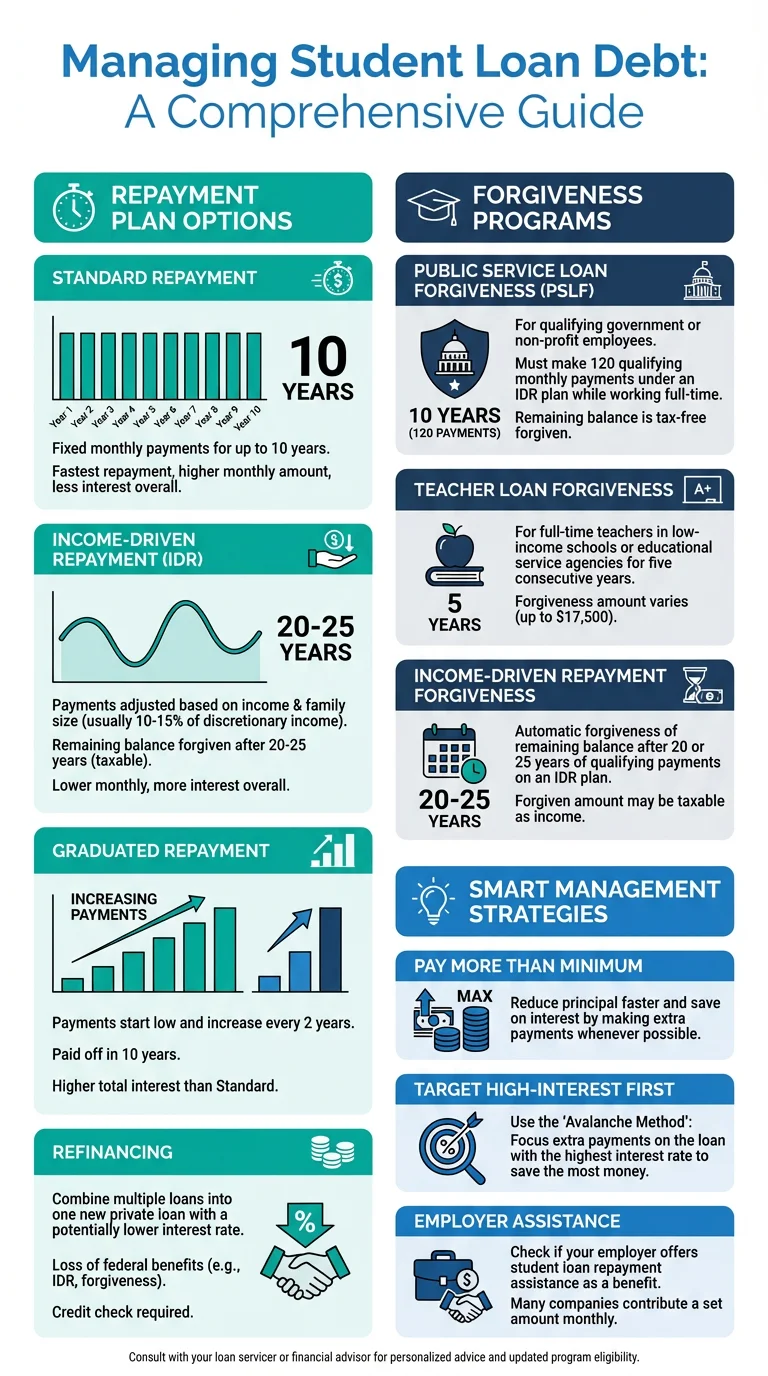

Managing Student Loan Debt

Repayment strategies and forgiveness programs

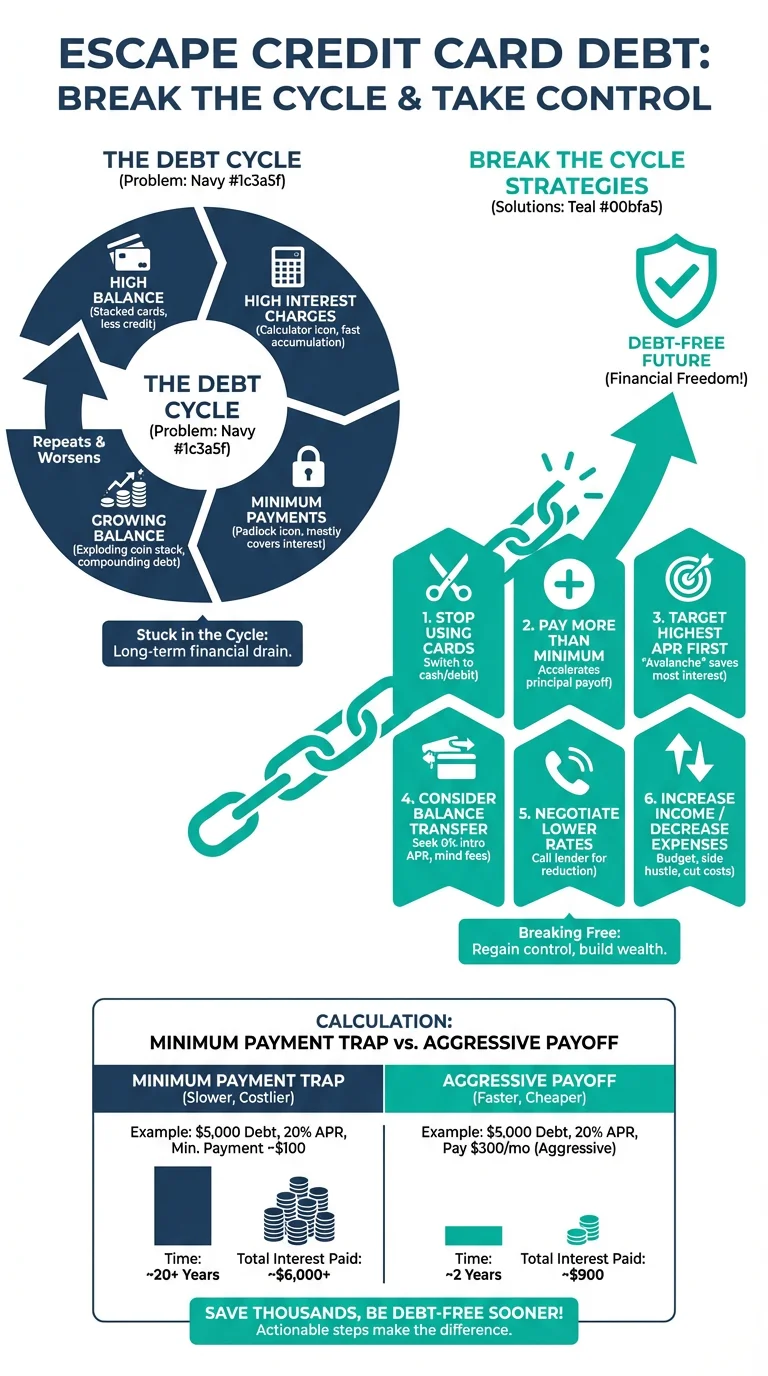

Escaping Credit Card Debt

Break free from high-interest credit card cycles

Investing 101

Start your investment journey with confidence

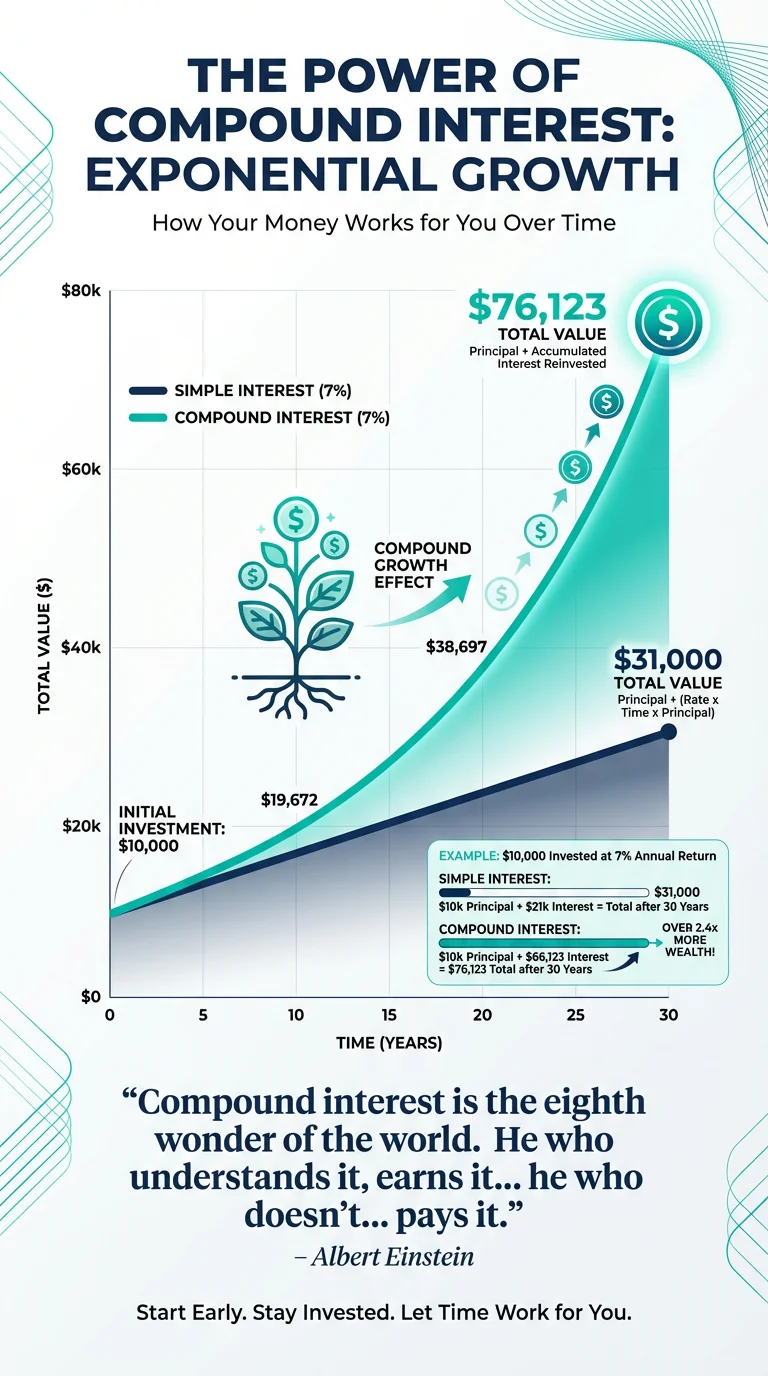

The Power of Compound Interest

How your money grows exponentially over time

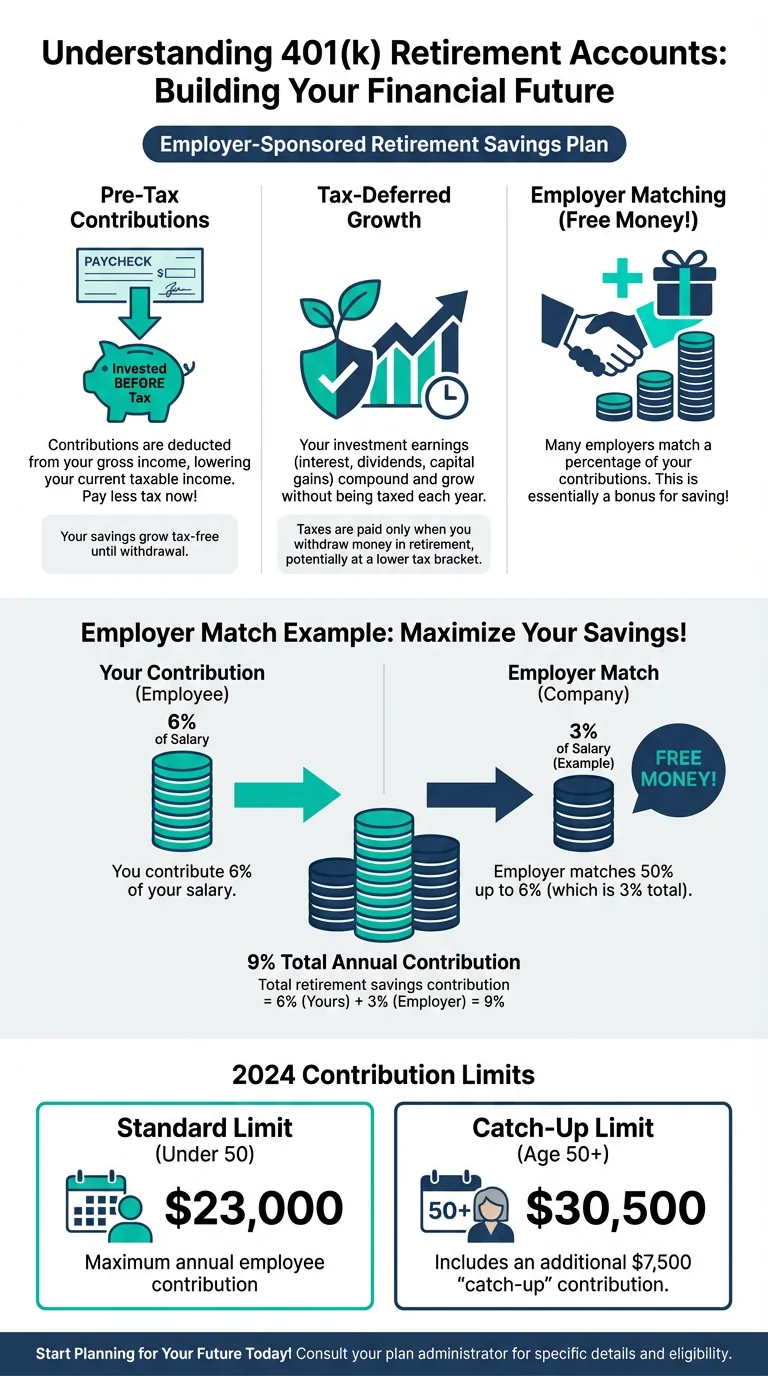

401(k) Retirement Accounts

Employer-sponsored retirement savings explained

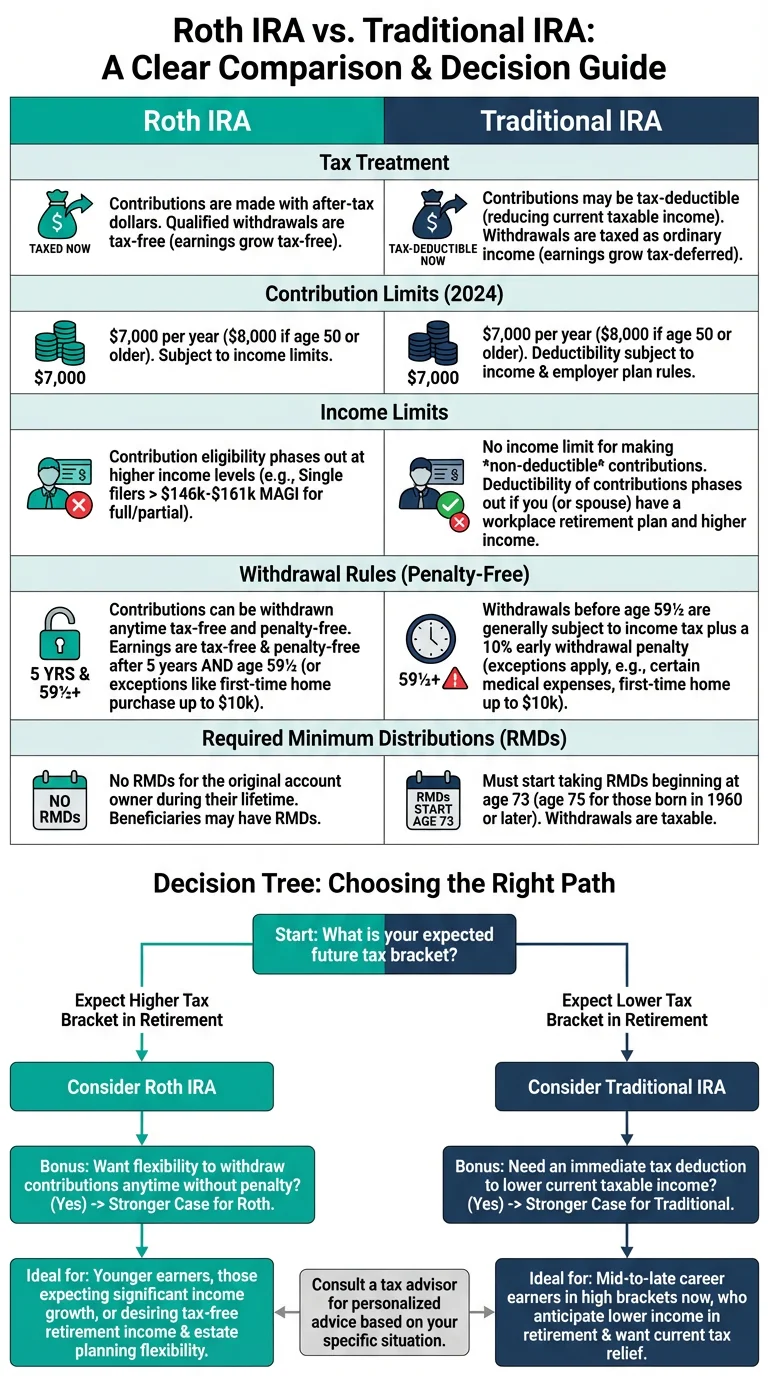

Roth IRA vs Traditional IRA

Choose the right retirement account for you

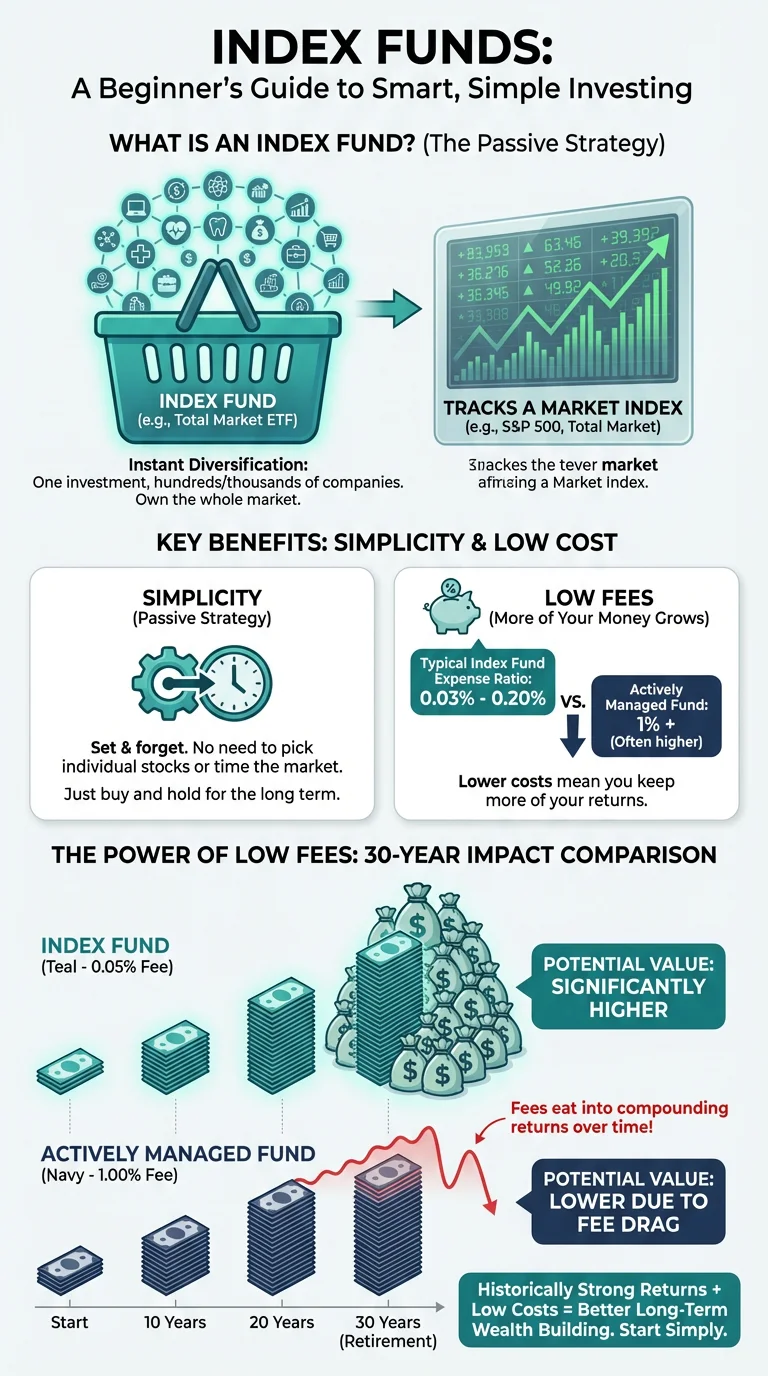

Index Funds for Beginners

Low-cost, diversified investing made simple

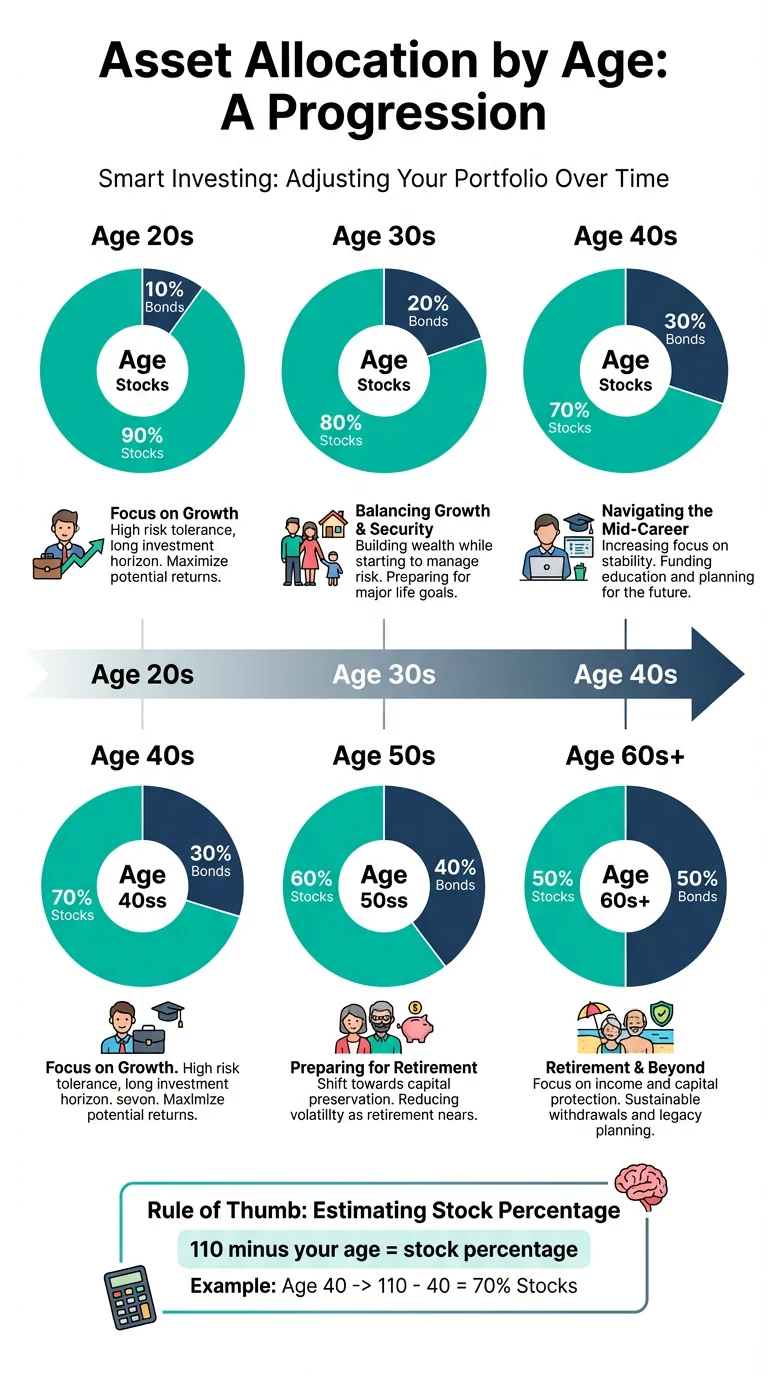

Asset Allocation by Age

How to balance stocks, bonds, and cash

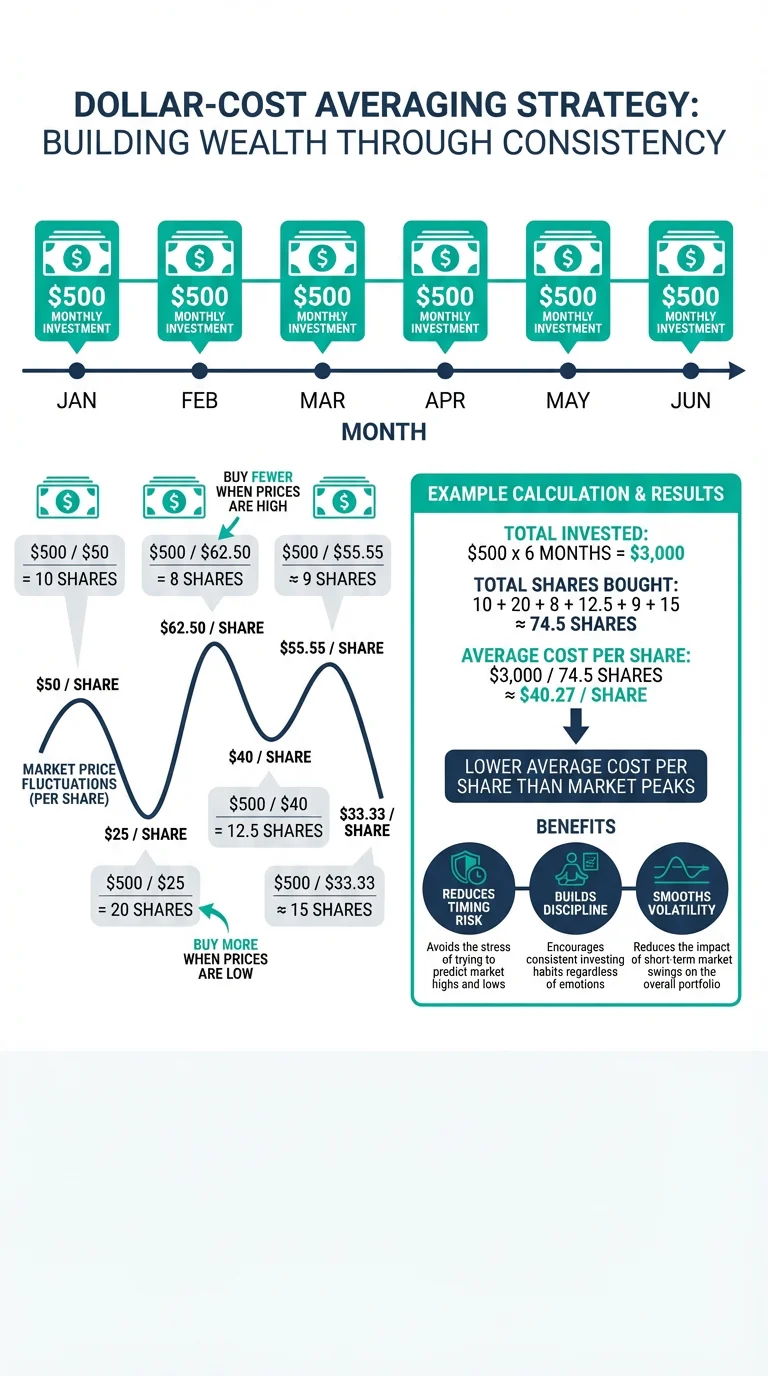

Dollar-Cost Averaging

Invest consistently regardless of market conditions

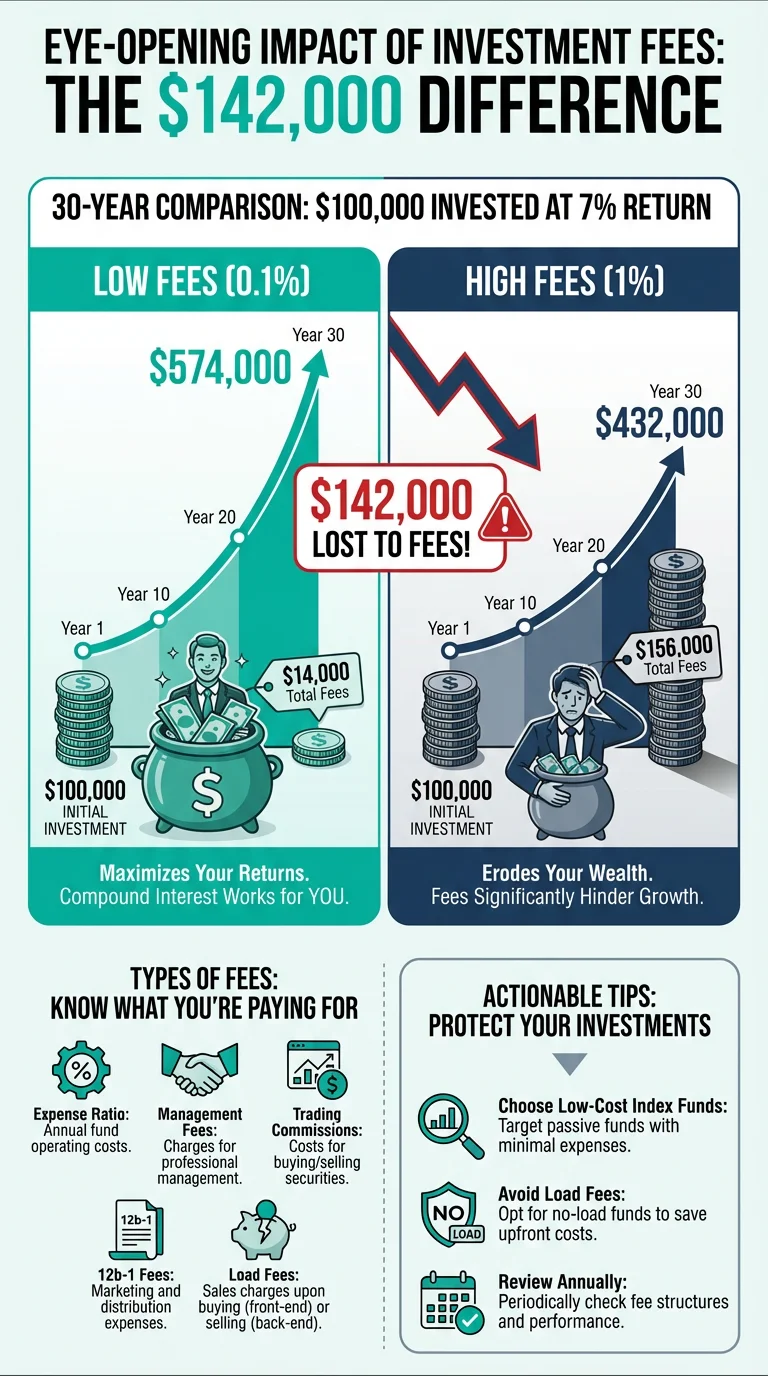

Understanding Investment Fees

How fees impact your long-term returns

Financial Planning

Long-term strategies for financial success

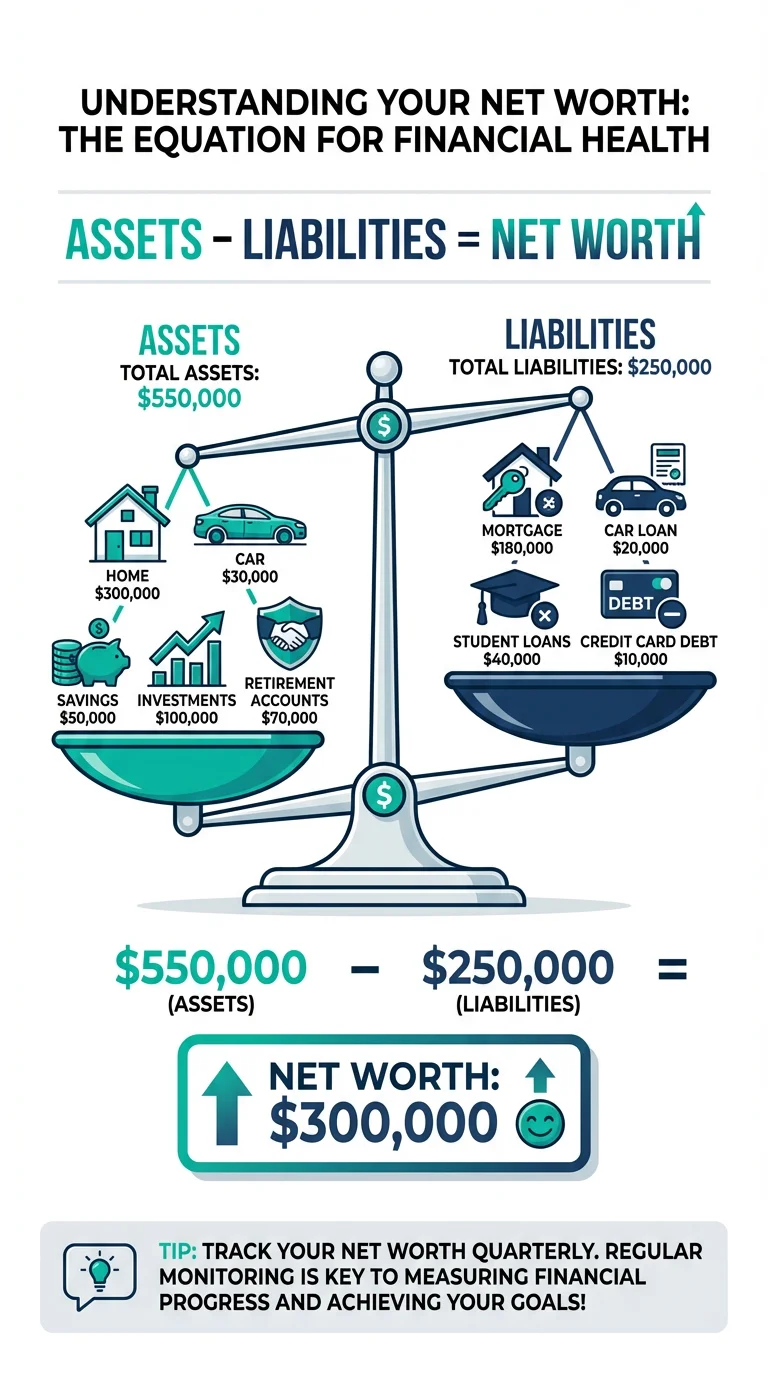

Calculating Your Net Worth

Assets minus liabilities = your financial health

Setting Financial Goals

Short-term, mid-term, and long-term planning

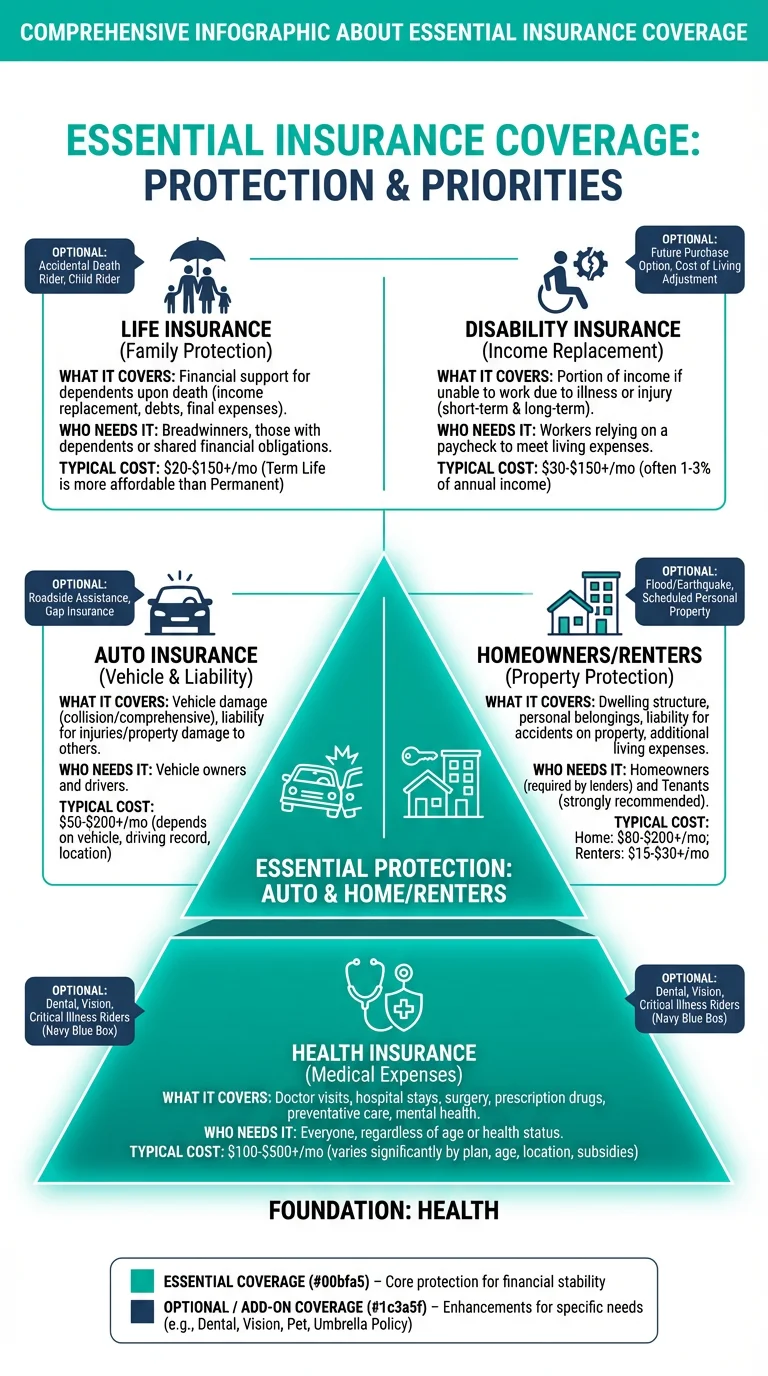

Essential Insurance Coverage

Protect yourself with health, life, and disability insurance

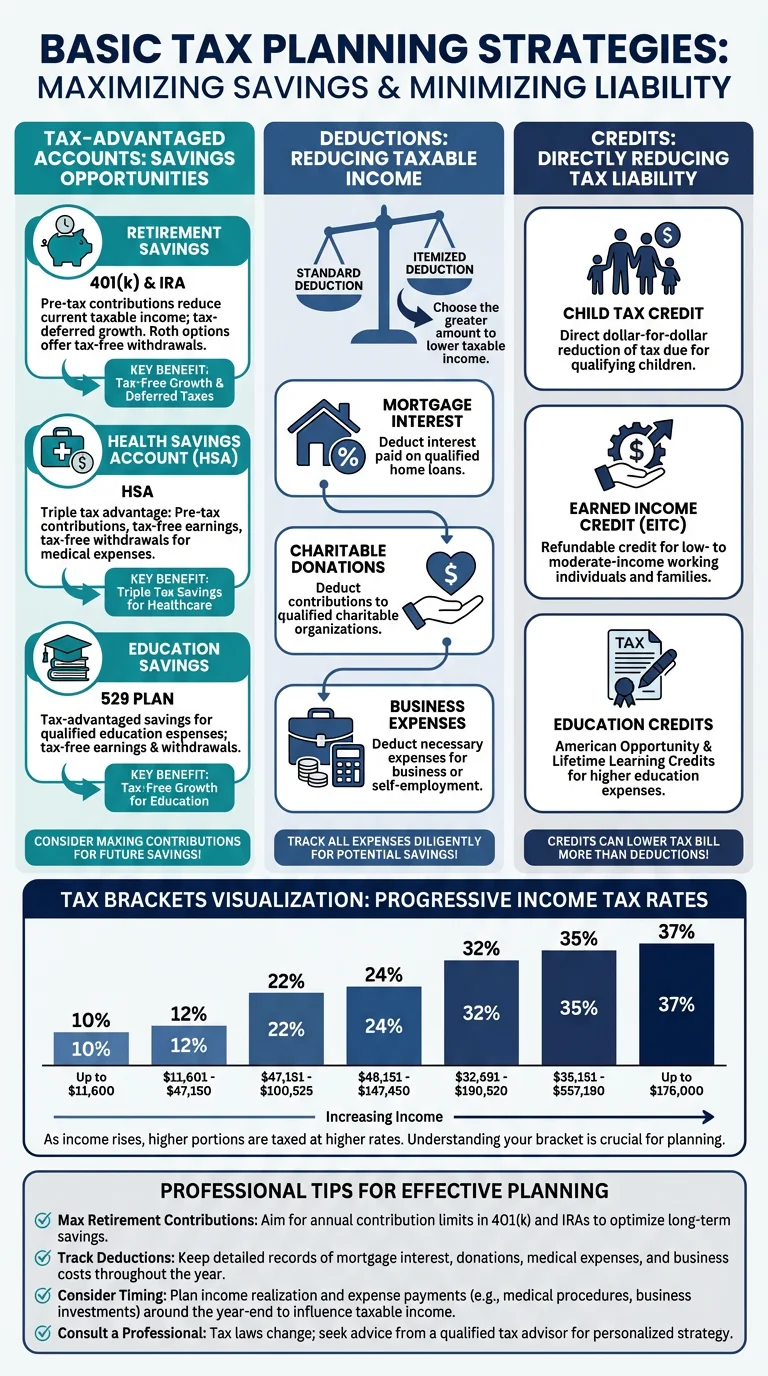

Basic Tax Planning Strategies

Legal ways to reduce your tax burden

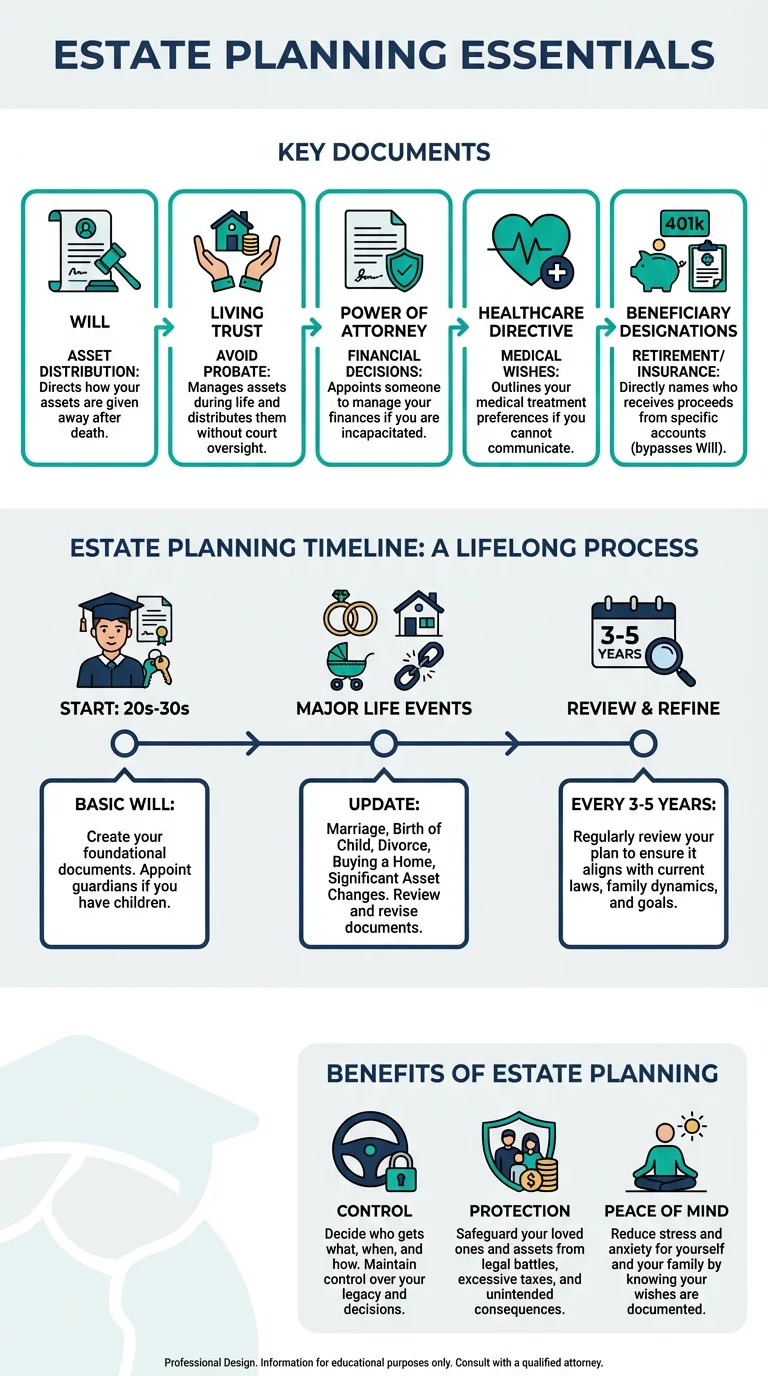

Estate Planning Essentials

Wills, trusts, and beneficiary designations

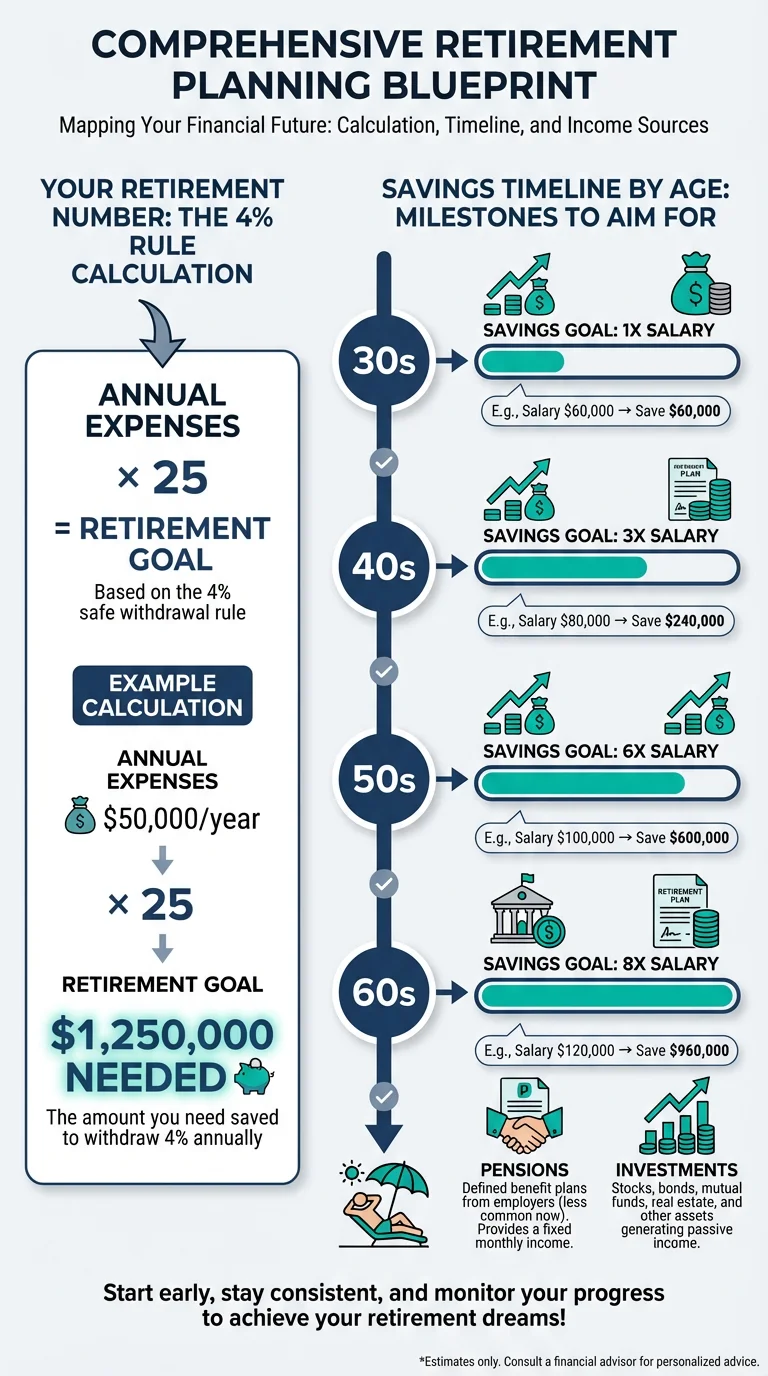

How Much to Save for Retirement

Calculate your retirement number and plan ahead

Money Mindset

Develop a healthy relationship with money

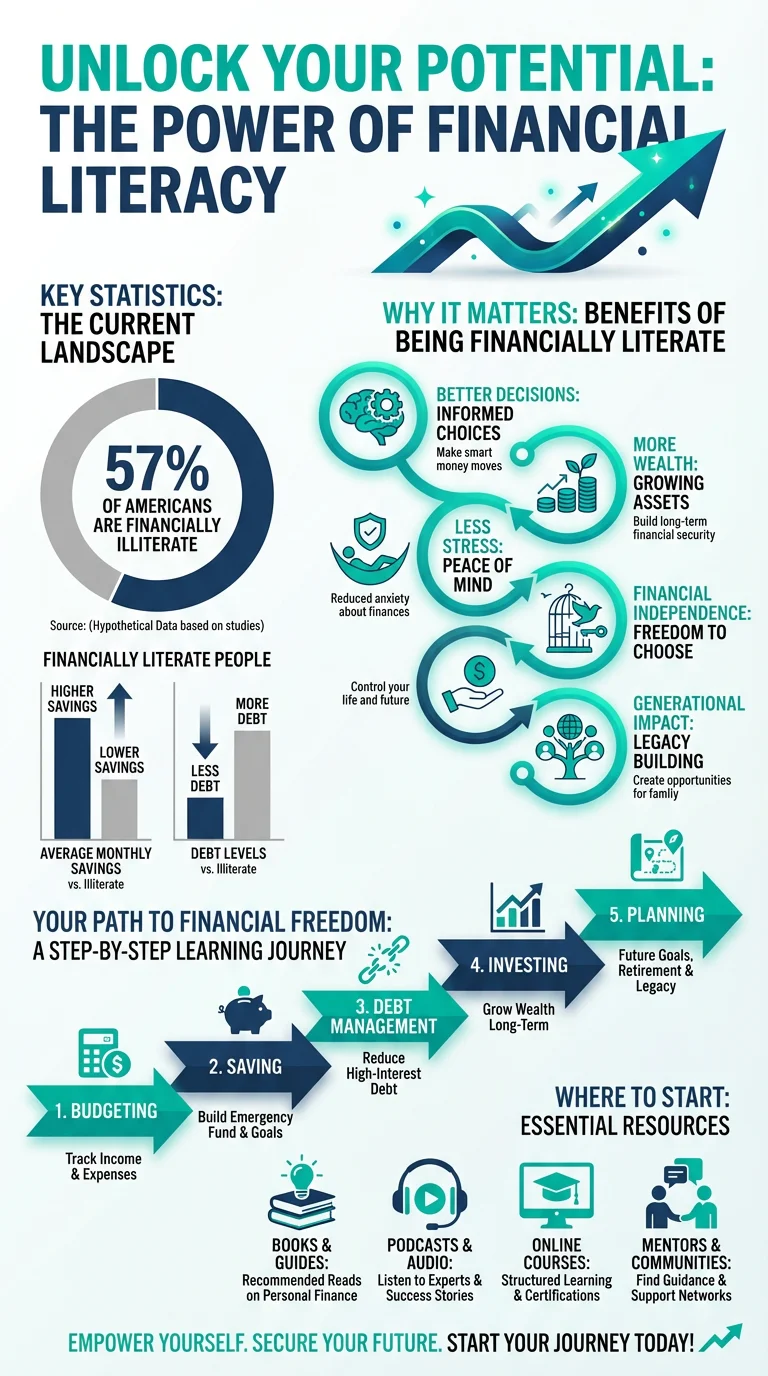

Why Financial Literacy Matters

Education is the foundation of wealth

Building Positive Money Habits

Small daily actions lead to big financial wins

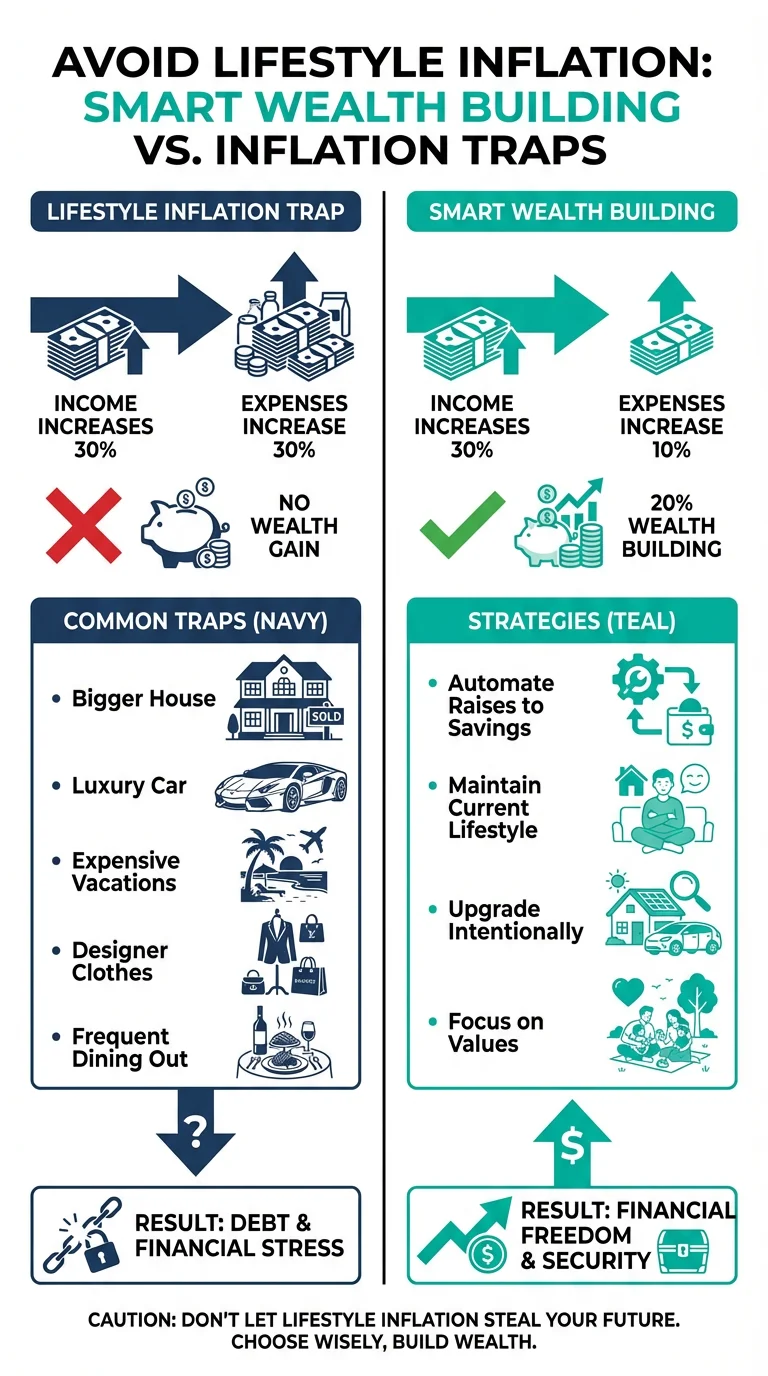

Avoiding Lifestyle Inflation

Keep expenses low as income grows

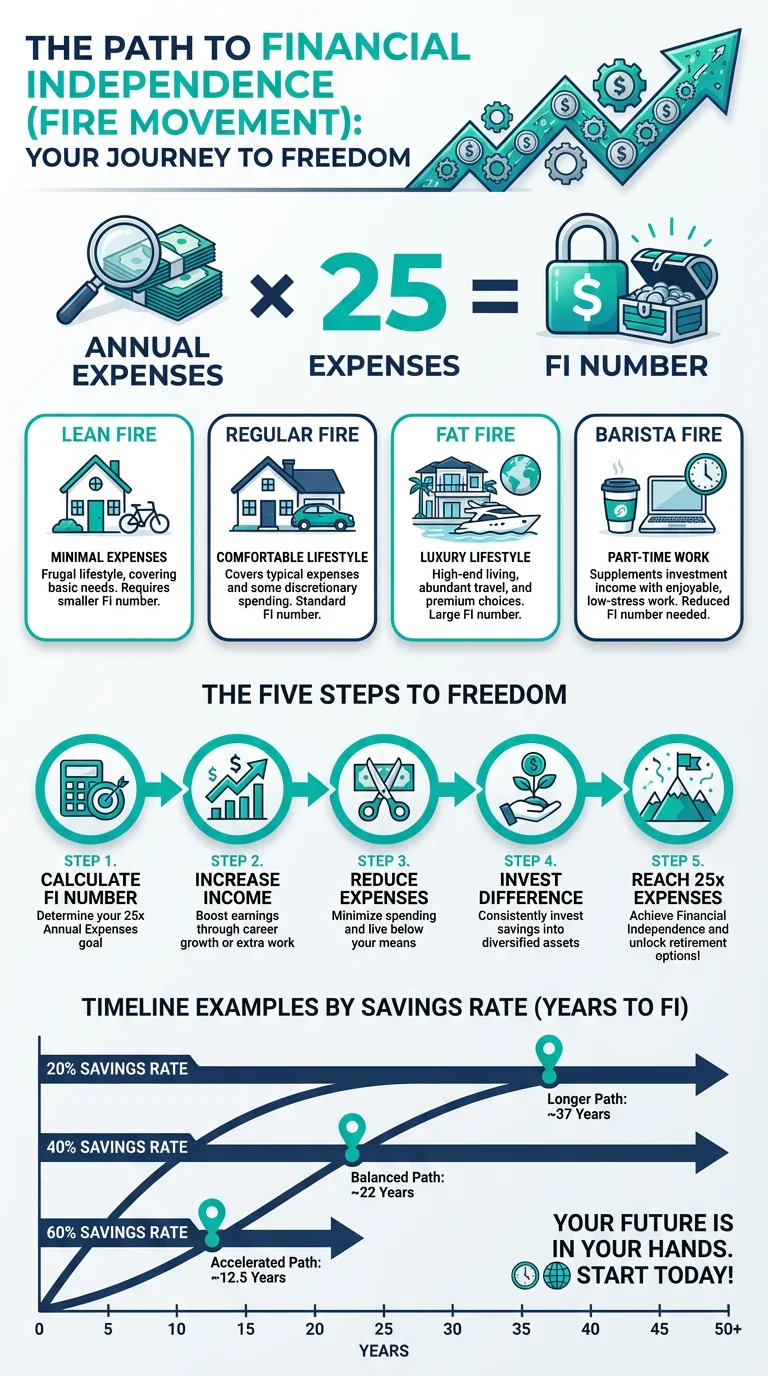

Path to Financial Independence

FIRE movement and early retirement strategies

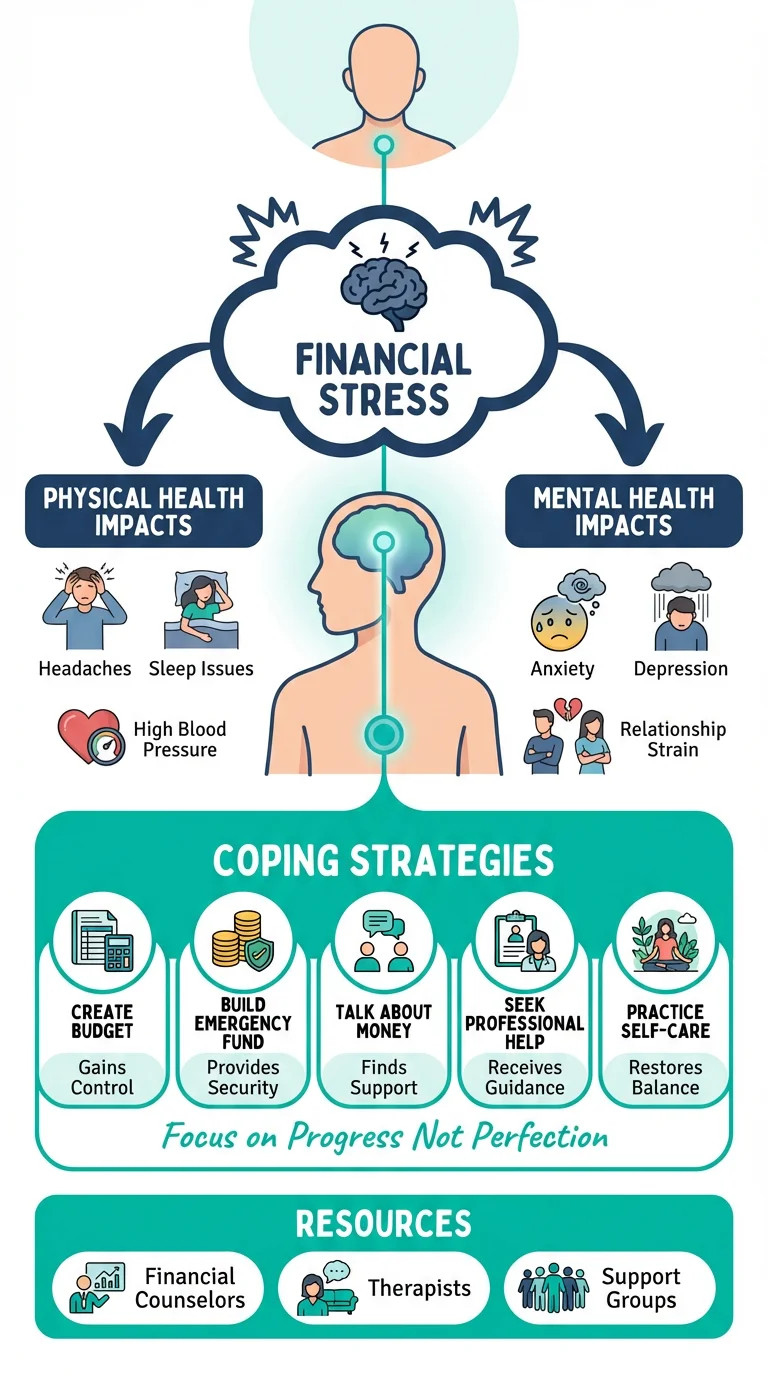

Managing Money-Related Stress

Mental health and financial wellness go together

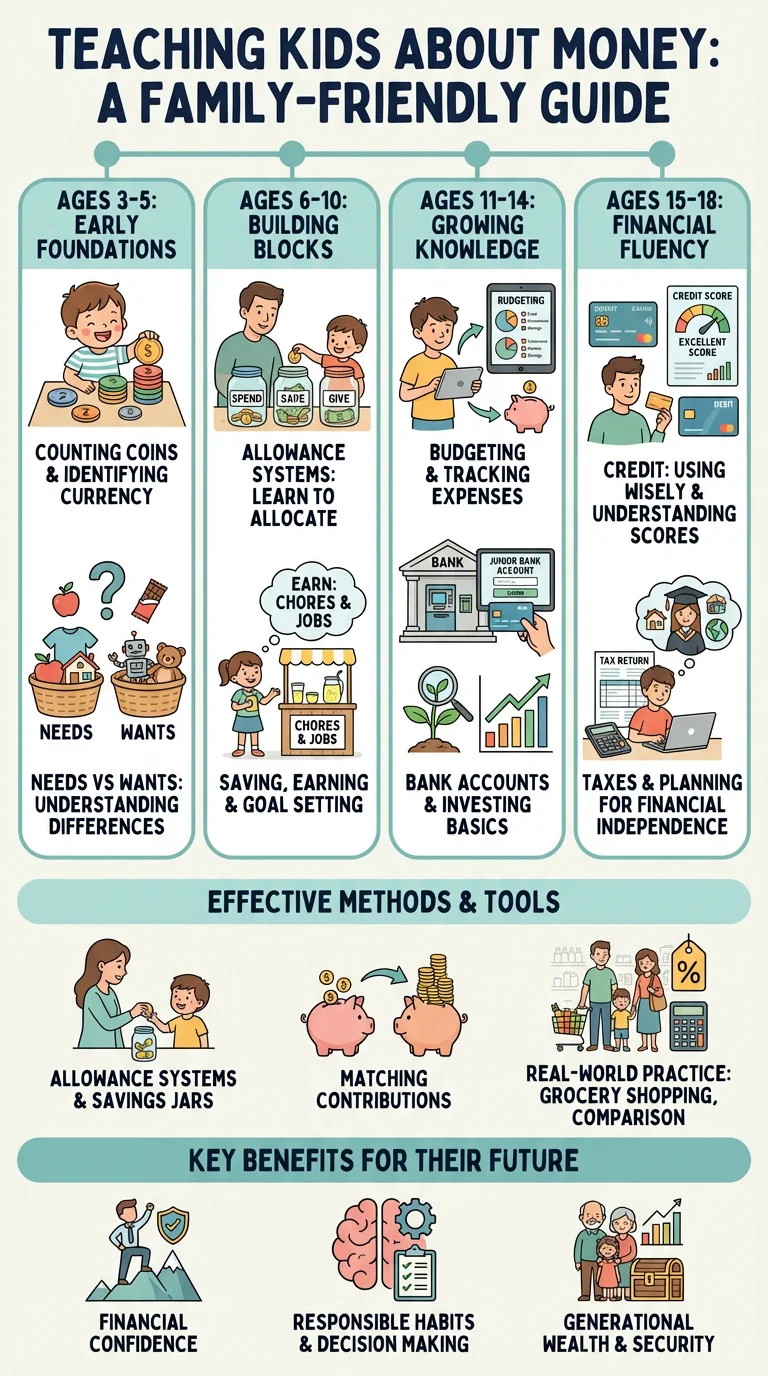

Teaching Kids About Money

Financial education starts at home